FEDS Notes

December 03, 2020

Dementia Harms Household Finances Years before Clinical Recognition

Joanne W. Hsu and Lauren Hersch Nicholas1

Alzheimer's Disease and Related Dementias (ADRD) are medical conditions characterized by deteriorating cognitive functions that are estimated to impact nearly 12 million older Americans by 2050. ADRD impedes independence in daily activities through symptoms including difficulties with memory and attention span, impaired judgement, and changing risk preferences. There are currently no effective medical treatments to delay or reverse symptoms of ADRD. Concerningly, many of these symptoms pose a threat to financial well-being. Indeed, medical research has shown that financial decision-making is one of the earliest functional capacities to be lost under ADRD, and numerous media accounts have documented anecdotes of loved ones first learning of a patient's cognitive decline after experiencing catastrophic financial events, such as foreclosure or asset depletion.2 In this Note, we describe our research examining patterns of adverse financial behavior before and after an ADRD diagnosis using a novel linkage of large-scale financial data and health data.3 Our study provides the first population-level evidence about the prevalence of ADRD-linked financial problems.

To characterize the evolution of consumer credit outcomes before and after ADRD diagnosis, we linked anonymized information about ADRD status from Medicare claims data to anonymized quarterly information on financial outcomes from credit reports derived from the FRBNY Consumer Credit Panel/Equifax. We compared the time-path of credit outcomes for Medicare beneficiaries with ADRD to those among beneficiaries who never develop ADRD, holding constant (age, sex, geography, year, quarter, and the presence of other health conditions). We focused on older adults living in single-person households, who would not have a cognitively normal spouse available to take over financial management.

We examined two indicators of financial well-being. The first was an indicator of payment delinquency, triggered if an individual was 30 or more days past due on at least one debt payment during the quarter. The second was an indicator of having a subprime credit score based on the Equifax Risk Score, a composite measure based on a person's credit history that summarizes their predicted risk of defaulting on loans over the subsequent 24 months. Subprime scores indicate higher default risk. We followed nearly 90,000 older adults for up to 20 years from 1999 - 2018.

We have several key findings.

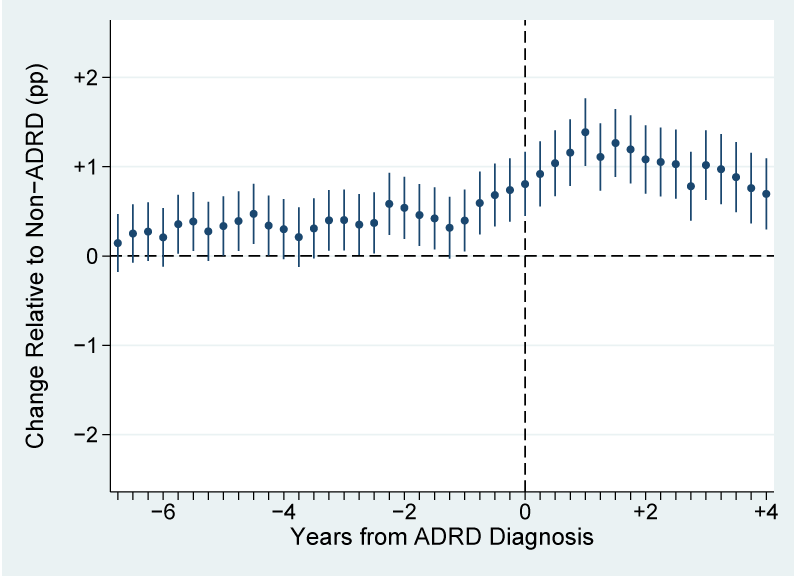

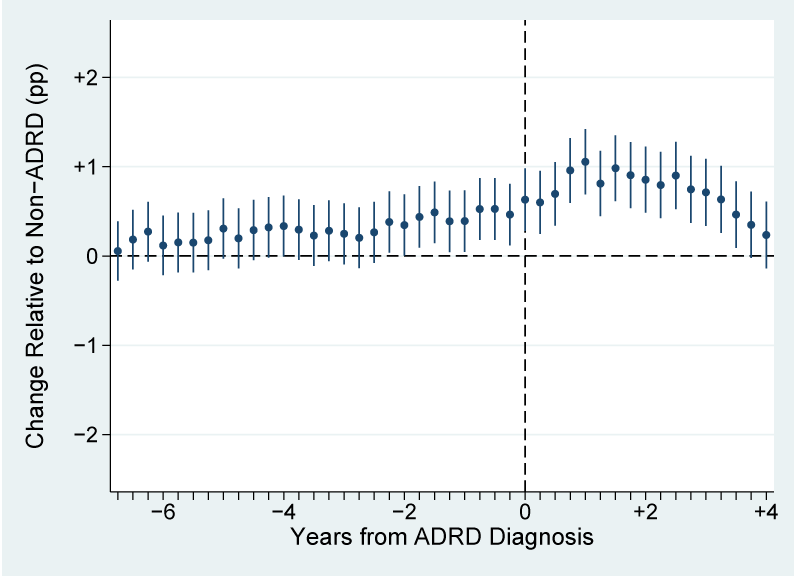

#1: Older adults who eventually develop ADRD are more likely to miss routine debt payments and develop subprime credit scores (Equifax Risk Scores) than those who never develop ADRD. The financial symptoms of ADRD present years prior to clinical diagnosis and persist for many patients following diagnosis. (Figures 1a and 1b).

Medicare beneficiaries who eventually develop ADRD experienced higher rates of delinquency than those who never developed ADRD, and these elevated rates were detectable starting 6 years before diagnosis. Elevated subprime credit scores began 2.5 years prior to diagnosis. At their peak, the increased rates of adverse financial outcomes attributed to ADRD accounted for 10 - 20% of events in this age group.

Figure 1a. Beneficiaries with Alzheimer's Disease and Related Dementias (ADRD) exhibit elevated payment delinquency years before a diagnosis, relative to those who are never diagnosed

Source: Nicholas, Langa, Bynum, and Hsu (2020). Circles are regression coefficients representing the percentage point (pp) increase in payment delinquency at each time point in comparison to payment delinquency rates among Medicare beneficiaries who are never diagnosed with ADRD. Vertical lines represent 95% confidence intervals. Data sources: FRBNY CCP/Equifax and Medicare Beneficiary Summary File, 1999-2018.

Figure 1b. Beneficiaries with ADRD begin showing elevated rates of subprime credit scores (Equifax Risk Score) before a diagnosis, relative to those who are never diagnosed

Source: Nicholas, Langa, Bynum, and Hsu (2020). Circles are regression coefficients representing the percentage point (pp) increase in subprime credit scores (Equifax Risk Scores) associated with each time point relative to no ADRD. Vertical lines represent 95% confidence intervals. Data sources: FRBNY CCP/Equifax and Medicare Beneficiary Summary File, 1999-2018.

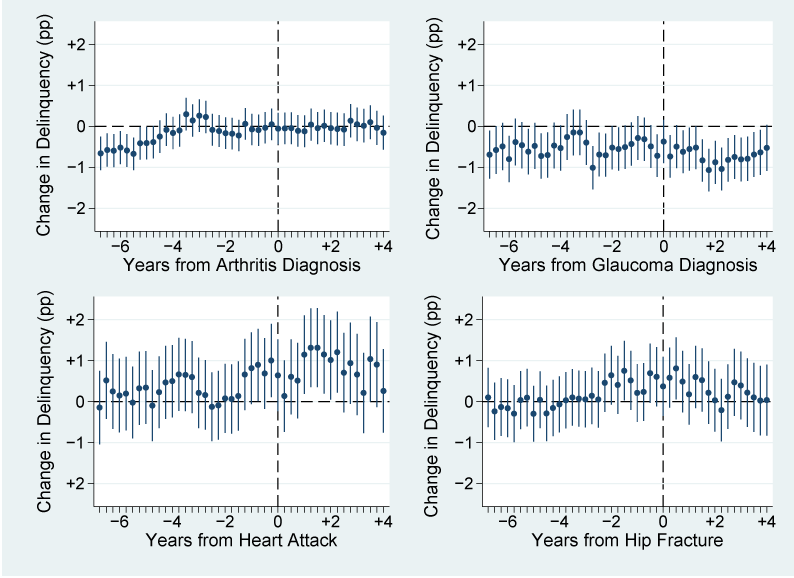

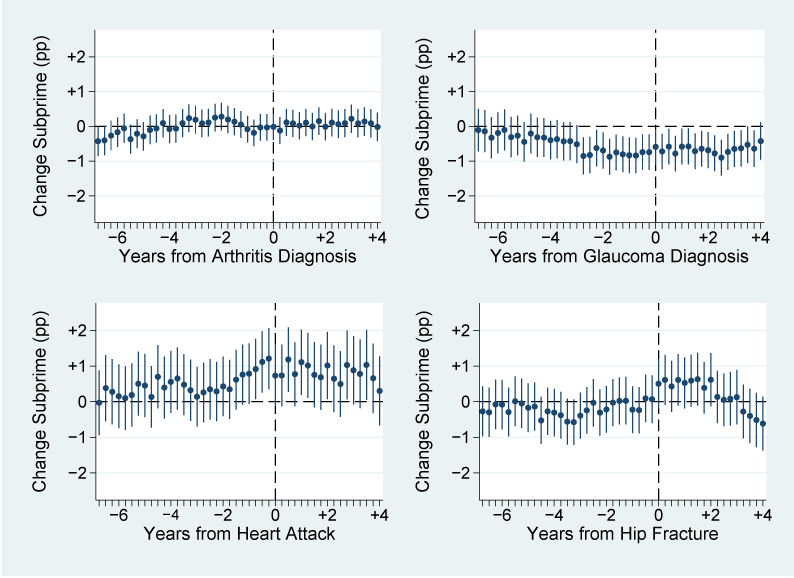

#2: The financial symptoms of ADRD are unique relative to other common medical problems. (Figures 2a and 2b).

To determine if the patterns we see are unique to ADRD or, alternatively, reflect aging or illness more generally, we conducted falsification tests using two gradual-onset conditions and two acute-onset conditions. In contrast to ADRD (Figures 1 - 2), beneficiaries who develop arthritis, glaucoma, heart attack or hip fracture did not exhibit systematically elevated rates of payment delinquency or subprime credit scores (Equifax Risk Score) before or after diagnosis. The fact that the financial symptoms we observe are unique to ADRD is consistent with medical research that shows that deterioration in financial capacity is an early indicator for ADRD.

Figure 2a. In contrast to ADRD (Figure 1a), beneficiaries who develop other health conditions do not exhibit systematically elevated payment delinquency before or after diagnosis

Source: Nicholas, Langa, Bynum, and Hsu (2020). Plotted coefficients are regression coefficients representing the percentage point (pp) change in rates of missed payments relative to Medicare beneficiaries who are never diagnosed with each of the health conditions. These serve as falsification tests for Figure 1a. Vertical lines represent 95% confidence intervals. Data sources: FRBNY CCP/Equifax and Medicare Beneficiary Summary File, 1999-2018.

Figure 2b. In contrast to ADRD (Figure 1b), beneficiaries who develop other health conditions do not exhibit systematically elevated subprime credit scores (Equifax Risk Scores) before or after diagnosis

Source: Nicholas, Langa, Bynum, and Hsu (2020). Plotted coefficients are regression coefficients representing the percentage point change in rates of subprime credit scores (Equifax Risk Scores) relative to Medicare beneficiaries who are never diagnosed with each of the health conditions. Vertical lines represent 95% confidence intervals. These serve as falsification tests for Figure 1b. Data sources: FRBNY CCP/Equifax and Medicare Beneficiary Summary File, 1999-2018.

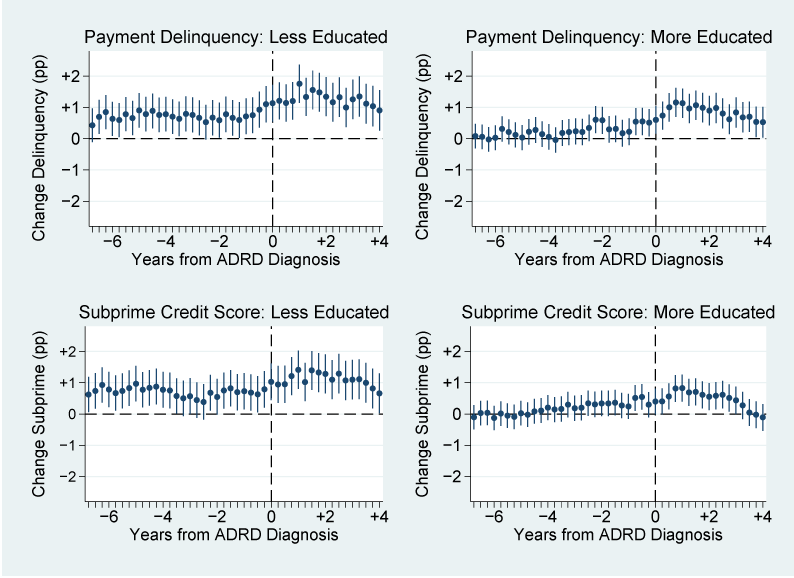

#3: Lower-educated seniors are more likely than higher-educated seniors to miss payments and develop subprime credit scores (Equifax Risk Scores) because of ADRD. For these lower-educated seniors, financial difficulties are present for a longer period prior to ADRD diagnosis. (Figure 3).

We stratified our analysis by education (based on census tract-level measures of education) to investigate the possibility that lower-educated beneficiaries may have, for example, fewer financial resources or less financial sophistication that could protect against adverse financial events. Indeed, our main findings are stronger, and emerge earlier, among beneficiaries in census tracts with less education.

Figure 3. Patterns of payment delinquency and subprime credit scores (Equifax Risk Scores) for beneficiaries who eventually developed ADRD are stronger in census tracts with below-median education

Source: Nicholas, Langa, Bynum, and Hsu (2020). Plots show percentage point (pp) change in payment delinquency and subprime credit scores (Equifax Risk Scores), relative to Medicare beneficiaries never diagnosed with ADRD, for less educated census tracts (left) and more educated census tracts (right). Vertical lines indicate 95% confidence intervals. Data sources: FRBNY CCP/Equifax and Medicare Beneficiary Summary File, 1999-2018; American Community Survey, 2010.

Taken together, our results provide critical evidence about how the diminished financial capacity associated with Alzheimer's Disease manifests, with adverse financial outcomes emerging well before a diagnosis at rates detectable in a population-level study. These findings highlight both the potential for financial information to help alert individuals about health problems at an early stage, as well as the potential to avoid more severe adverse financial events through early detection of dementia. We estimate that older Americans pay up to $670 in credit card penalty interest and fees in the four years prior to dementia diagnosis because of these undetected financial symptoms. Greater financial harms can come from missed mortgage or property tax payments. Our data did not allow us to study withdrawals from bank or retirement accounts or service loss from missed utility payments, implying that our results represent a portion of the total financial losses caused by dementia.

1. The analysis and conclusions set forth are those of the authors and do not reflect the views of the Board of Governors or the Federal Reserve staff. Hsu: Division of Research and Statistics, Board of Governors of the Federal Reserve System, [email protected], ORCID 0000-0002-0715-6230; Nicholas: Johns Hopkins School of Public Health & School of Medicine, [email protected]. Return to text

2. See, for example, Daniel C. Marson (2001) "Loss of Financial Competency in Dementia: Conceptual and Empirical Approaches." Aging, Neuropsychology, and Cognition 8(3): 164-181, https://doi.org/10.1076/anec.8.3.164.827; Ozioma C. Okonkwo, Virginia G. Wadley, H Randall Griffith, Katherine Belue, Sara Lanza, Edward Y. Zamrini, Lindy E. Harrell, John C. Brockington, David Clark, Rema Raman, and Daniel C. Marson (2008) "Awareness of Deficits in Financial Abilities in Patients With Mild Cognitive Impairment: Going Beyond Self-Informant Discrepancy," The American Journal of Geriatric Psychiatry 16(8): 650-659, https://doi.org/10.1097/JGP.0b013e31817e8a9d; Eric Widera, Veronika Steenpass, Daniel Marson, Rebecca Sudore (2011) "Finances in the Older Patient With Cognitive Impairment: 'He Didn't Want Me to Take Over'," JAMA 305(7): 698–706, https://doi.org/10.1001/jama.2011.164; R. Nathan Spreng, Jason Karlawish, and Daniel C. Marson (2016) "Cognitive, social, and neural determinants of diminished decision-making and financial exploitation risk in aging and dementia: A review and new model," Journal of Elder Abuse & Neglect 28(4-5): 320-344, https://doi.org/10.1080/08946566.2016.1237918; Gina Kolata (2010) "Money Woes Can Be Early Clue to Alzheimer's" New York Times. October 31, 2010 Return to text

3. This Note describes the findings of a more detailed companion piece, Lauren Hersch Nicholas, Kenneth M. Langa, Julie P.W. Bynum, and Joanne W. Hsu (2020) "The Financial Presentation of Alzheimer's Disease," JAMA Internal Medicine. Published online 30 November 2020. https://jamanetwork.com/journals/jama/fullarticle/10.1001/jamainternmed.2020.6432 Return to text

Hsu, Joanne W., and Lauren Hersch Nicholas (2020). "Dementia Harms Household Finances Years before Clinical Recognition," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, December 3, 2020, https://doi.org/10.17016/2380-7172.2825.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.