FEDS Notes

September 25, 2023

Global Inflation Uncertainty and its Economic Effects

Juan M. Londono, Sai Ma, and Beth Anne Wilson1

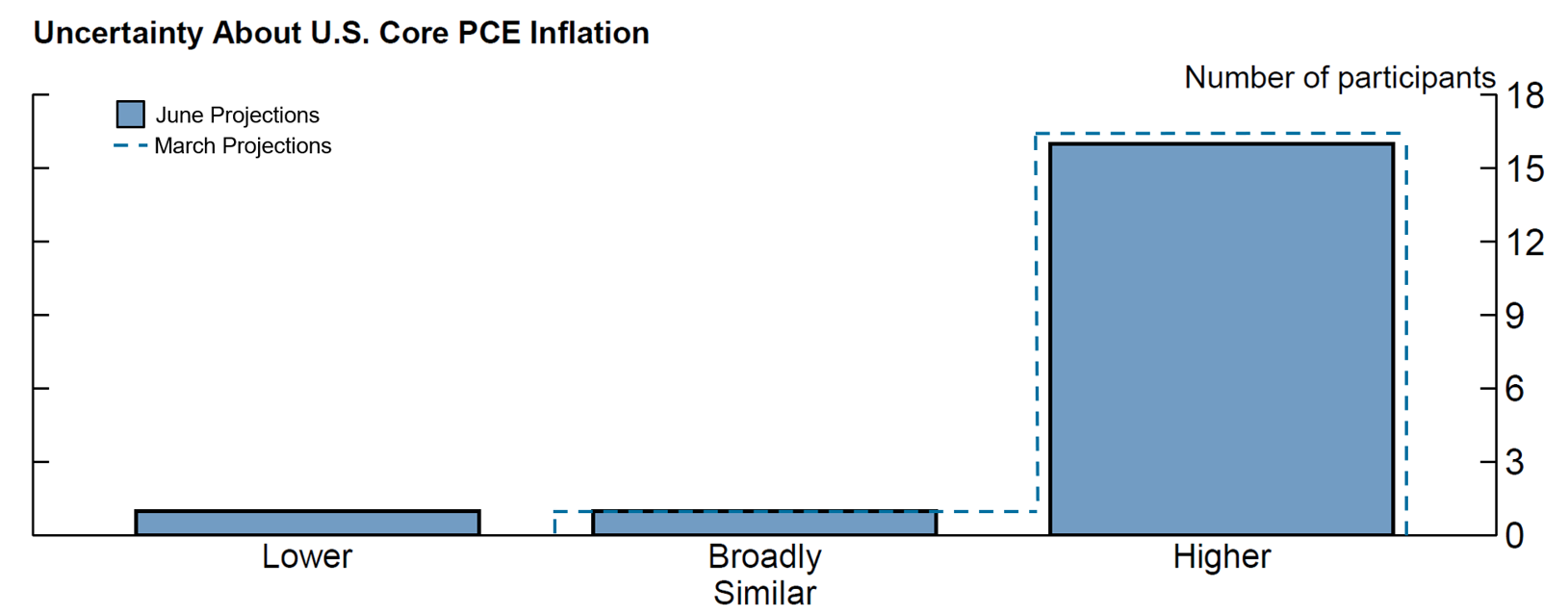

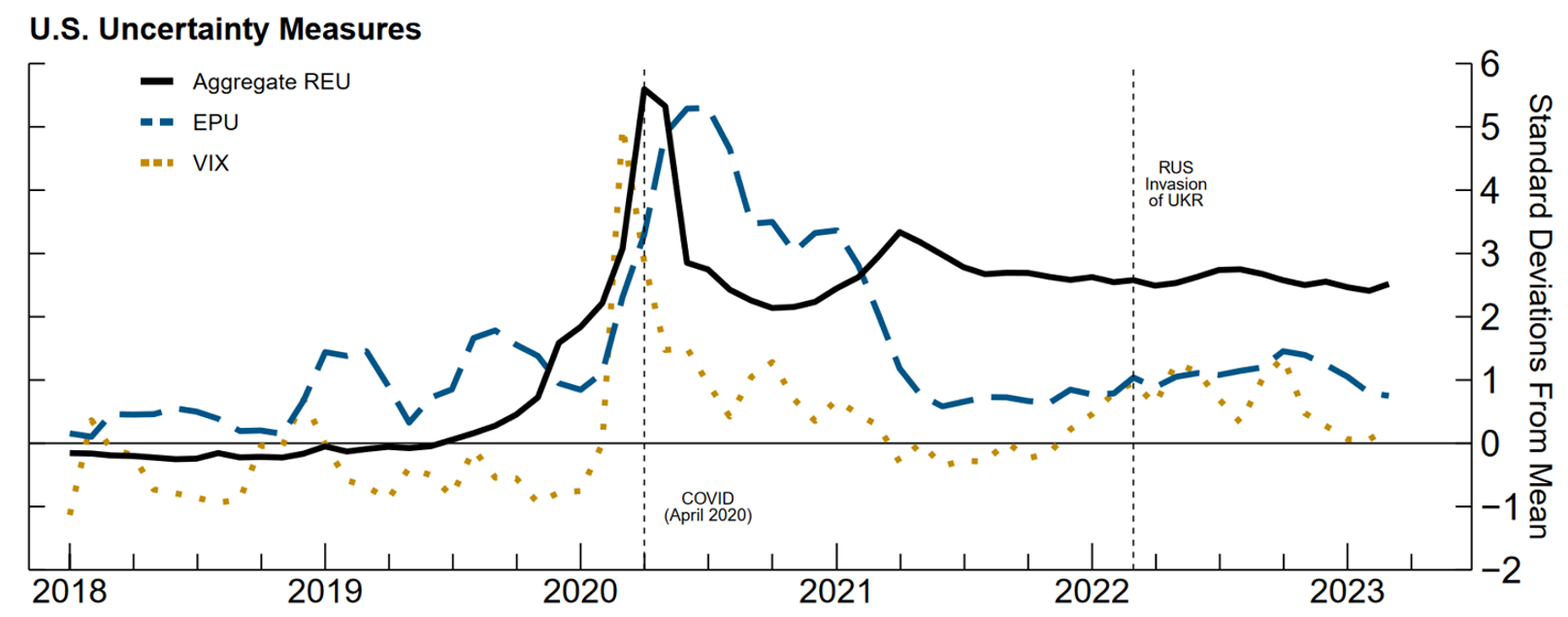

Policymakers, including Federal Open Market Committee (FOMC) participants, have been stressing the elevated level of uncertainty, especially related to inflation, and the challenge this poses for monetary policy. As seen in Figure 1, with few exceptions, FOMC participants see the level of uncertainty around their forecasts for core PCE inflation as high, compared to the average over the past 20 years. Policymakers are not the only ones. The July Federal Reserve Beige Book, which summarizes the commentary of businesses on current economic conditions, repeated the words "uncertain" and "uncertainty" over 20 times, much more than the average and with much of the uncertainty associated with inflation. It is interesting, therefore, as seen in Figure 2, that widely used measures of uncertainty, such as the VIX or the text-based economic policy uncertainty in Baker, Bloom, and Davis (2016), commonly known as EPU, do not seem to be capturing this sense of uncertainty, but instead have been relatively subdued over the past two years. In contrast, the measure of real economic uncertainty proposed by Jurado, Ludvigson, and Ng (2015), which we abbreviate as REU, has held at historically elevated levels since the beginning of the pandemic.

Note: Data as of June 14, 2023. Judgments refer to uncertainty of projections of Core PCE inflation to typical levels of forecast uncertainty seen in the past 20 years.

Source: Summary of Economic Projections

This discrepancy across measures may not be entirely surprising given REU is capturing a different type of uncertainty using a different methodology than that of the VIX, the EPU, and other existing measures of uncertainty.2 For example, the VIX captures the near-term hedging desire of investors in the U.S. stock market, and the EPU is the share of news articles discussing uncertainty about various aspects of economic policy broadly defined and as such captures the salience of uncertainty regarding economic policy as highlighted in the news. REU, on the other hand, tries to capture in an objective way at any point in time the predictability of the economy. The harder it is to predict how the economy will evolve, the greater is the value of REU. REU is purely based on economic fundamentals, rather than reflecting perceptions or sentiment, and uses a data-driven econometric methodology. As such, it aims to assess the uncertainty about future economic conditions that households and firms consider when making their decisions. Because of that, to the extent that policymakers have been focused on uncertainty about the underlying behavior of the macroeconomy, REU is more specifically focused on that type of uncertainty.

Note: Series are standardized over January 1990 to March 2023. EPU series are 4-month rolling averages.

Source: Yahoo Finance from ICE Data Services; Main Economic Indicators via OECD; Baker, Bloom, and Davis (2016); Jurado, Ludvigson, and Ng (2015); Londono, Ma, and Wilson (2023).

Constructing Real Economic Uncertainty

To calculate REU for the United States, we follow a methodology similar to that in Jurado, Ludvigson, and Ng (2015) and Ludvigson, Ng, and Ma (2021). We take 130 variables related to the macroeconomy, including output, labor markets, prices, and housing markets. Using over 200 monthly domestic and global financial and economic variables as predictors, we compute the month-ahead forecast for each variable.3 We then derive a measure of how far off these forecasts are from the actual values at each point in time. Economic uncertainty is calculated by aggregating these measures across all 130 variables. Intuitively, when it becomes harder to predict economic variables, REU increases.

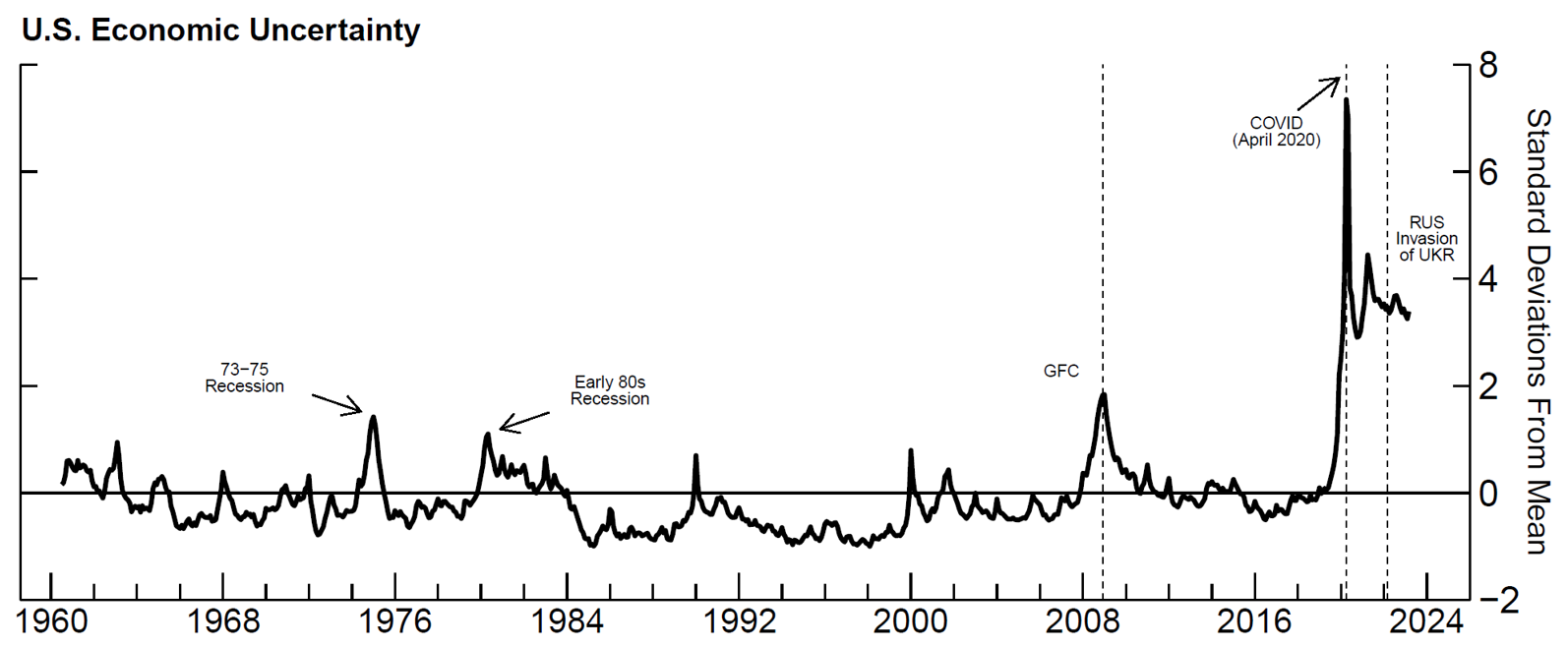

Figure 3 shows U.S. REU since 1960, shown as standard deviations from the mean. This uncertainty measure spikes during recessions, including the global financial crisis (GFC) and the COVID-19 pandemic, marked with vertical lines. The rise of uncertainty early in the pandemic is unprecedented and REU has since remained exceptionally elevated. Given that the pandemic was exogenous and unprecedented, at least within our sample, it is possible that the sharp rise in REU is just reflecting the challenges of predicting conditions during the shutdown and reopening of the economy with only our standard set of predictors. To address this concern, we include variables such as the number of deaths from COVID-19, the stringency index from the University of Oxford, and the Federal Reserve Bank of New York's supply chain pressure index as predictors. These controls should allow our REU measure to better identify the uncertainty related to the lack of forecastability of economic variables from the actual COVID-19 shocks.

Note: Series is standardized over its historical mean (July 1960 to March 2023).

Source: Main Economic Indicators via OECD; Jurado, Ludvigson, and Ng (2015); Londono, Ma, and Wilson (2023).

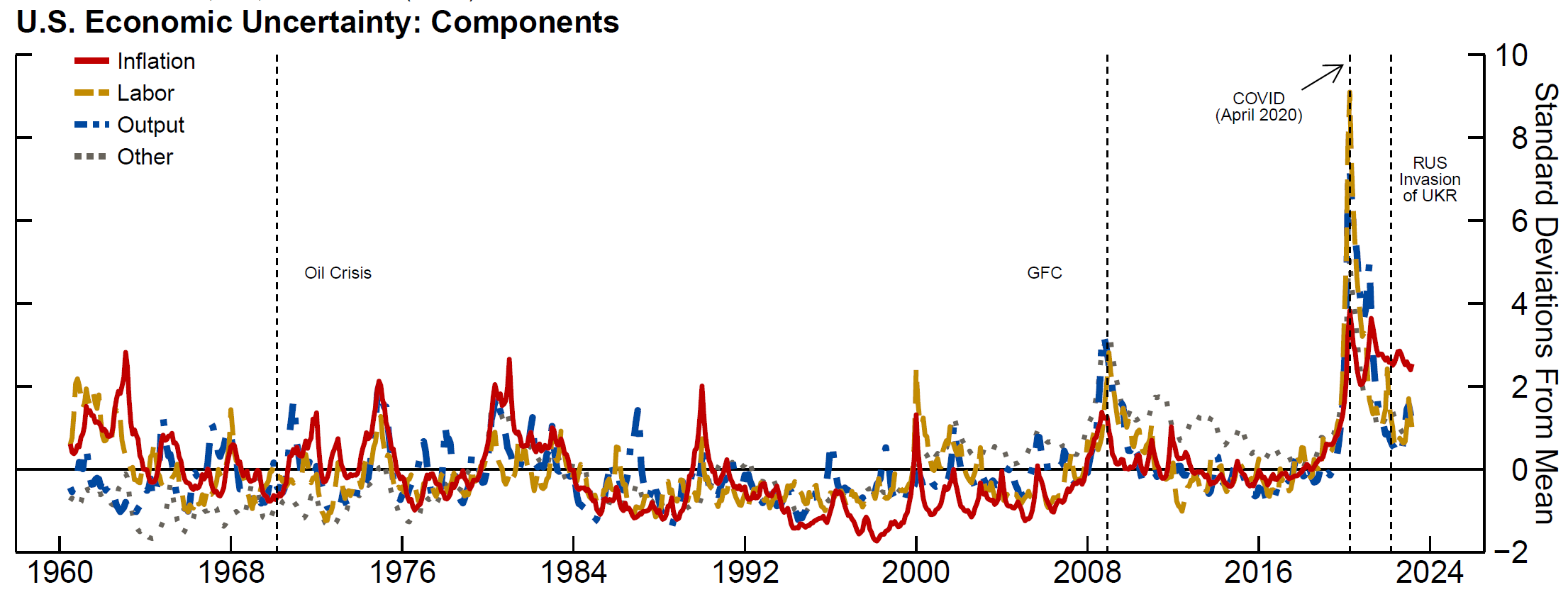

What is Keeping Economic Uncertainty so Elevated?

To hone in on what is driving the surge in REU over the last few years, we decompose REU into various subcomponents related to aspects of the macroeconomy.4 Figure 4 shows U.S. economic uncertainty components for inflation indicators, labor market conditions, metrics of output, and other components. All components rose significantly during the pandemic but behave quite differently after 2021, with inflation uncertainty becoming the dominant source of aggregate economic uncertainty, especially since the Russian invasion of Ukraine. A message one could take from this is that, through the eyes of an econometrician with a rich set of predictors, inflation over the last two years was just objectively really hard to predict. In fact, more difficult to predict by far than any time in the last 60 years.

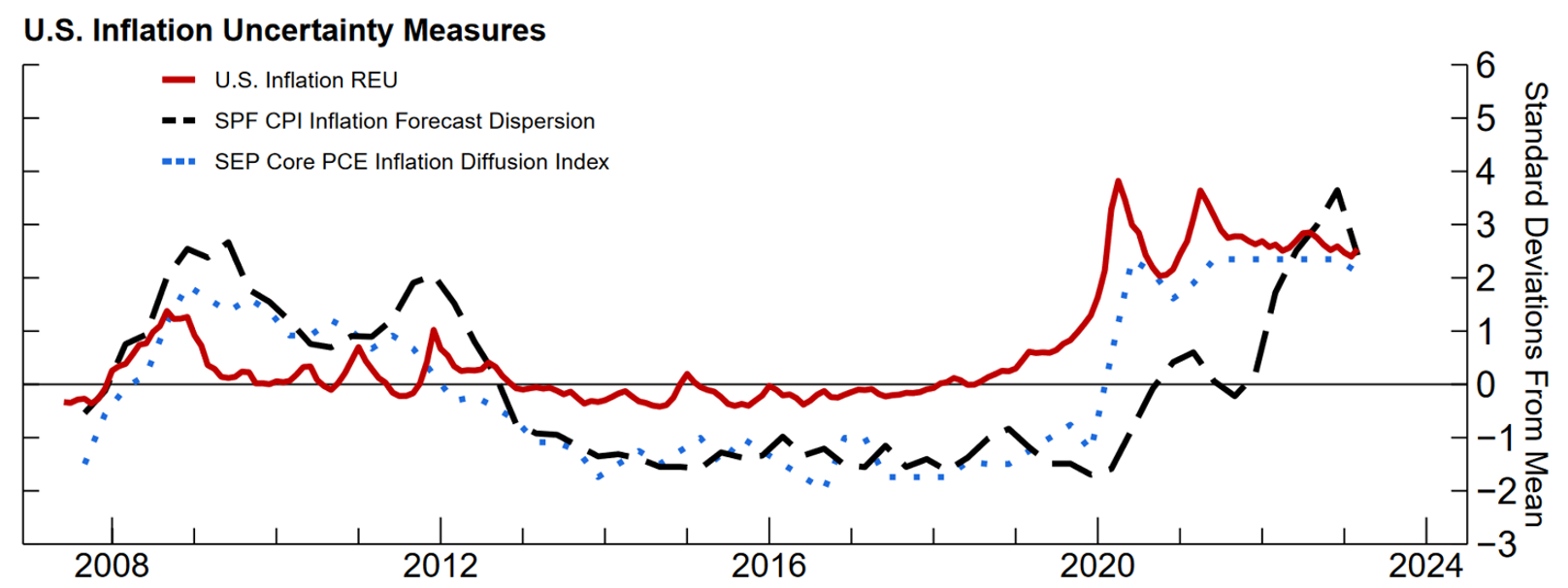

As shown in Figure 5, episodes of high inflation uncertainty according to our metric coincide with episodes when professional and FOMC forecasters also disagree more about future inflation. The PCE inflation diffusion index from the summary of economic projections (SEP) of FOMC members and the dispersion of CPI inflation forecasts from the survey of professional forecasters (SPF) are also very high. It makes sense that in periods when it is objectively harder to predict inflation, we would see a greater range in inflation forecasts and greater divergence among experts.

Note: Series are standardized over their historical means (July 1960 to April 2023).

Source: Main Economic Indicators via OECD; Jurado, Ludvigson, and Ng (2015); Londono, Ma, and Wilson (2023).

*On October 18, 2023, this figure was updated to fix an error in the plotted data for the U.S. inflation uncertainty series.

Note: Series are standardized over their historical means. SPF CPI inflation forecast dispersion is the difference between 75/25 percentiles of 4-quarter- ahead CPI projections of FOMC members and shown as a 4-quarter rolling average.

Source: Summary of Economic Projections; Survey of Professional Forecasters; Main Economic Indicators via OECD; Londono, Ma, and Wilson (2023).

The Global Nature of Inflation Uncertainty

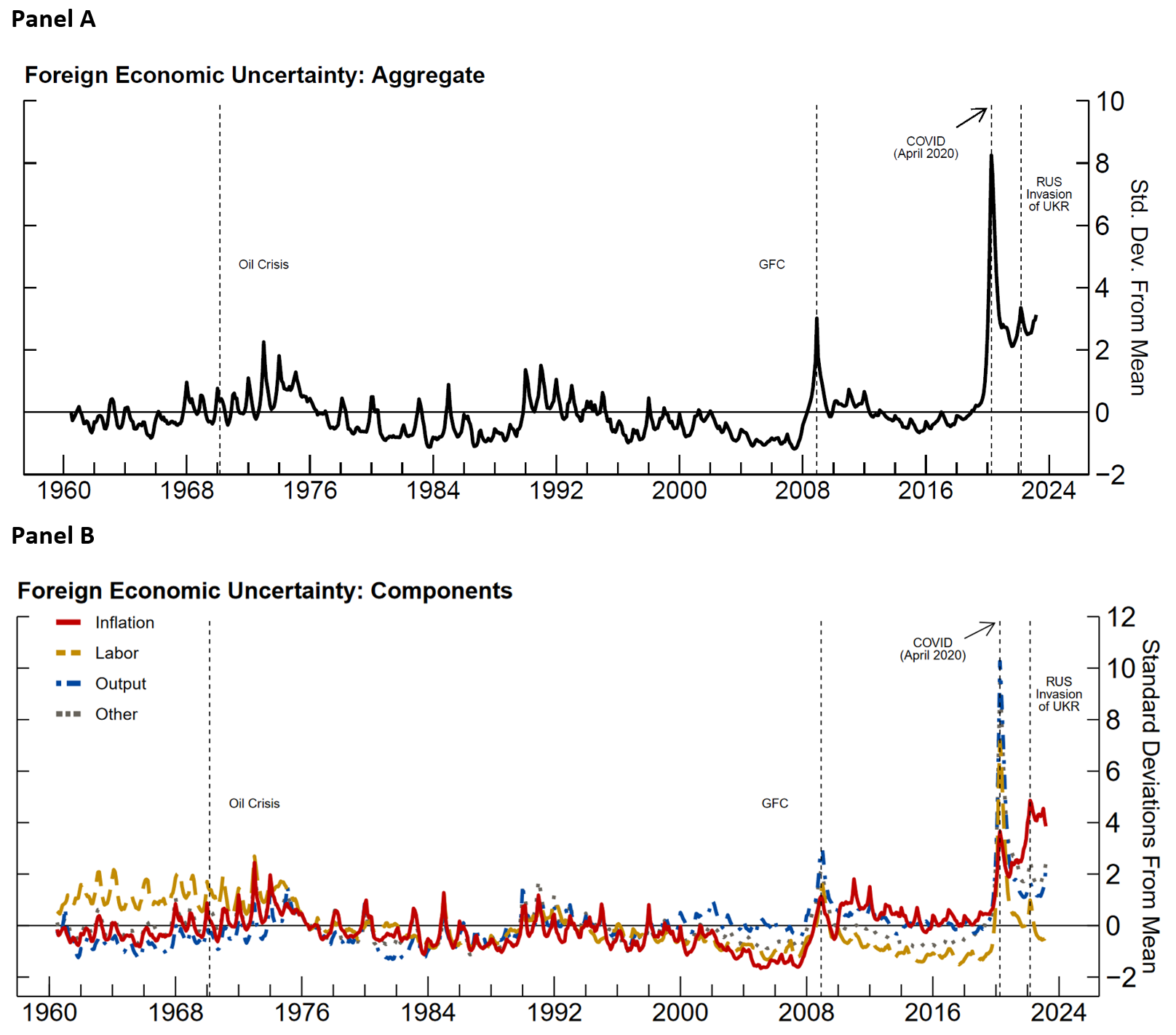

The rise in inflation and inflation uncertainty has been a global phenomenon in the post-COVID era. Following the methodology in Londono, Ma, and Wilson (2023), we construct economic uncertainty measures for 38 other countries which, together with the U.S., represent close to 90 percent of global GDP as of 2019. Panel A of Figure 6 plots a non-US (foreign) economic uncertainty index calculated as the equally weighted average of the REU measures for all the foreign economies in our sample. As with U.S. REU, the foreign index spikes around the GFC, soars around the COVID pandemic, and has remained quite elevated since, at around 3 standard deviations above its historical mean. Panel B shows the components of foreign REU: inflation, labor, output, and others. Again, as for the U.S., foreign inflation uncertainty has become the dominant source of economic uncertainty over the last two years.

Note: Foreign REU series are the equally weighted average across non- U.S. countries. Series is standardized over its historical mean (July 1960 to March 2023).

Source: Main Economic Indicators via OECD; Londono, Ma, and Wilson (2023).

Inflation Uncertainty and Monetary Policy Uncertainty are Correlated

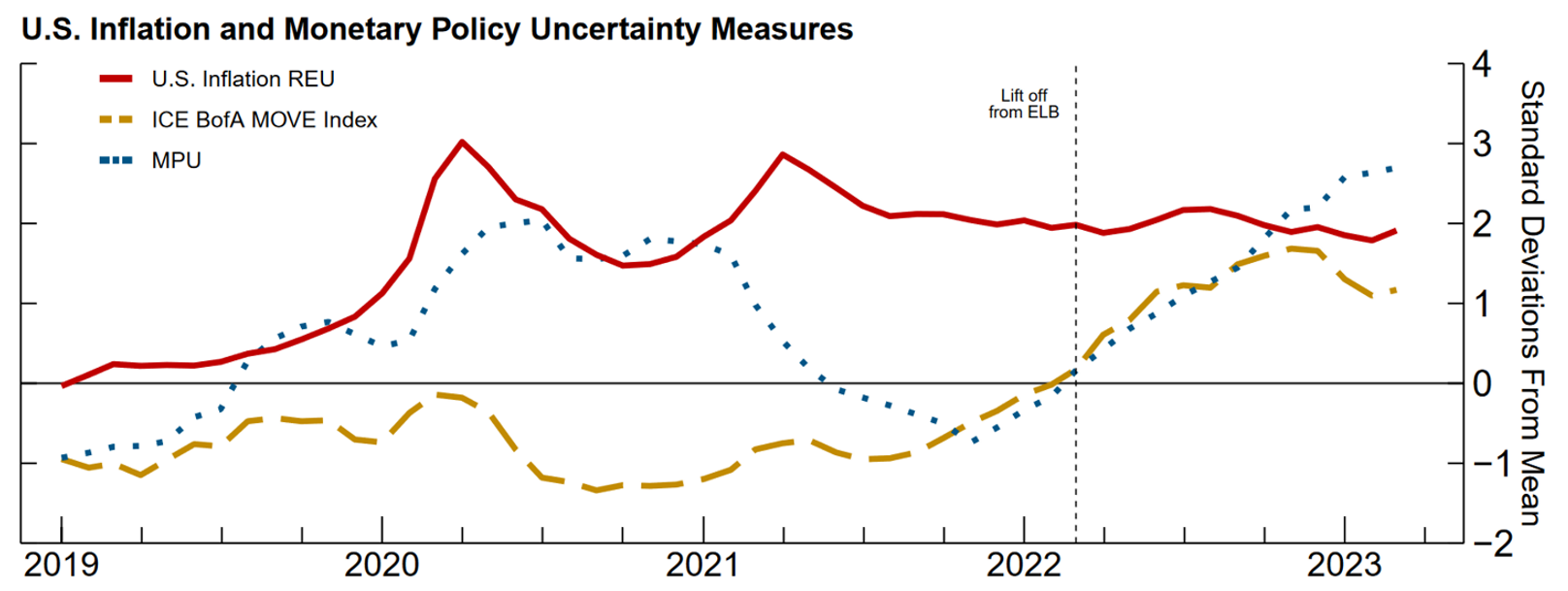

It makes sense that persistently high inflation uncertainty, especially around monetary policy turning points, would be associated with a more uncertain path for monetary policy. Figure 7 compares U.S. inflation REU with two monetary policy uncertainty measures. One is the ICE BofaML MOVE index, which is a financial uncertainty measure calculated as the option-implied volatility of U.S. Treasury rates. The other is a text-based monetary policy uncertainty known as MPU. The figure shows that both financial and text-based measures of monetary policy uncertainty increased as rates lifted off the effective lower bound in 2022, and the current level of monetary policy uncertainty and inflation REU are well above their historical averages. While these two monetary policy measures capture different types of uncertainties from the inflation REU, this chart points to a correlation between inflation uncertainty and monetary policy uncertainty.

Note: Series are standardized over November 2002 to April 2023. Monetary Policy Uncertainty (MPU ) and ICE BofA MOVE Index series are respectively 12- and 4-month rolling averages.

Source: Yahoo Finance from ICE Data Services; Main Economic Indicators via OECD; Baker. Bloom, and Davis (2016); Londono, Ma, and Wilson (2023).

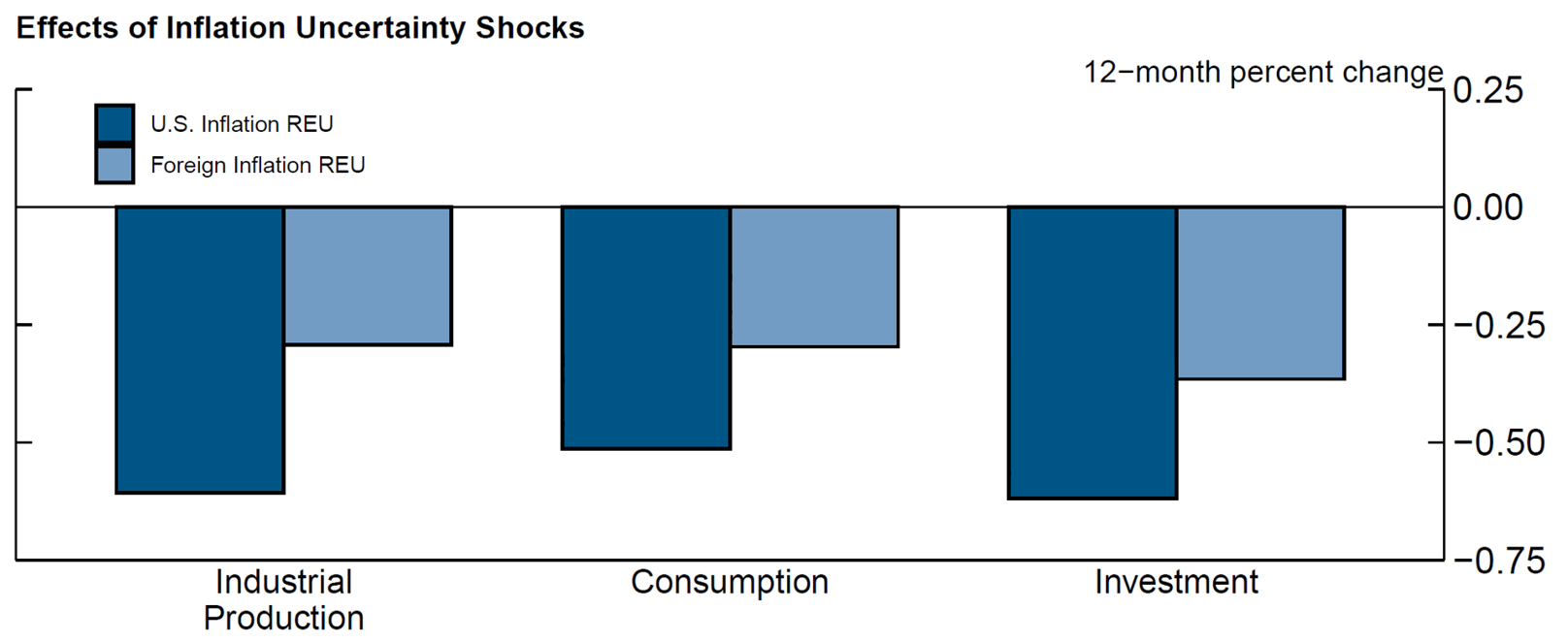

Note: Response after one year to a three-standard deviation shock to inflation uncertainty. Key identifies in order from left to right.

Source: Londono, Ma, and Wilson (2023).

Economic Implications of Elevated Inflation Uncertainty

An increase in inflation uncertainty might have significant economic effects. We assess the economic effects on the U.S. economy of an increase in domestic and foreign inflation uncertainty, and we explore potential transmission channels of inflation uncertainty to the economy. To account for endogeneity among uncertainty and other variables, as it is traditional in the literature, we use a vector autoregression (VAR) model to assess the economic effects of a three-standard-deviation shock in inflation uncertainty. The VAR model consists of U.S. and foreign inflation uncertainty, the level of inflation in the U.S. and foreign countries, measures of growth, the Fed funds rate, and the VIX.

As the dark blue bars show, such a large shock in U.S. inflation uncertainty is followed by sizable declines in industrial production, consumption, and investment after 12 months. Higher foreign inflation uncertainty also has significant domestic effects, as seen by the light blue bars. This effect is statistically significant and around half that of domestic inflation uncertainty.

In summary, our research provides evidence that around the world the path of inflation has been historically and objectively difficult to predict since the pandemic started. This rise in U.S. inflation uncertainty may be acting as a headwind to U.S. growth and pose challenges for monetary policy as explained by the simultaneous increase in the uncertainty for the path of the monetary policy rate and the differential effects of inflation uncertainty on investment, consumption, and hiring. We also find evidence of international transmission of foreign inflation uncertainty, and several potential channels could contribute to such international transmission; we leave this important topic for future research.

References

Baker, Scott R., Nicholas Bloom, and Steven J. Davis (2016). "Measuring Economic Policy Uncertainty," Quarterly Journal of Economics 131(4): 1593–1636.

Cascaldi-Garcia et al. (2023). "What is Certain about Uncertainty," Journal of Economic Literature 61(2): 624-654.

Federal Reserve Bank of Minneapolis (July 2023), The Beige Book, Summary of Current Economic Conditions.

Jurado, Kyle, Sydney C. Ludvigson, and Serena Ng (2015). "Measuring Uncertainty," American Economic Review 105 (3): 1177–1216.

Ludvigson, Ma, and Serena Ng (2021). "Uncertainty and Business Cycles: Exogenous Impulse or Endogenous Response?," American Economic Journal: Macroeconomics 13(4): 369-410.

Londono, Juan M., Sai Ma, and Beth Anne Wilson (2023). "The Global Transmission of Real Economic Uncertainty," Journal of Money, Credit, and Banking (forthcoming).

Ng, Serena (2021). "Modeling Macroeconomic Variations after Covid-19," NBER working paper.

1. Juan M. Londono ([email protected]) is a Senior Economic Project Manager, Sai Ma ([email protected]) is a Senior Economist in the International Financial Stability Section, and Beth Anne Wilson ([email protected]) is the Director. All authors are in the Division of International Finance, Board of Governors of the Federal Reserve System, Washington, D.C. 20551 U.S.A.. We thank Thomas Li and Dylan Saez for outstanding research assistance, and participants at the International Finance Division policy workshop for their comments. The views in this note are solely the responsibility of the authors and should not be interpreted as reflecting the views of the Board of Governors of the Federal Reserve System or of any other person associated with the Federal Reserve System Return to text

2. See Cascaldi et al. (2023) for a discussion on the broad differences among uncertainty measures and for details on the methodology and object of uncertainty of a wide range of uncertainty measures suggested in the literature. Return to text

3. For the COVID-19 period (2020 Jan to 2022 June), we follow Ng (2021) and use a mean-shift model for the prediction regression to account for structural changes in the mean of economic variables. Return to text

4. Specifically, we divide our 130 economic variables into groups related to inflation, labor market conditions, output, and all other variables and calculate group-specific REU measures. Return to text

Londono, Juan M., Sai Ma, and Beth Anne Wilson (2023). "Global Inflation Uncertainty and its Economic Effects," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, September 25, 2023, https://doi.org/10.17016/2380-7172.3391.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.