FEDS Notes

August 28, 2020

Implementing Monetary Policy in an “Ample-Reserves” Regime: Maintaining an Ample Quantity of Reserves (Note 2 of 3)

Jane Ihrig, Zeynep Senyuz, and Gretchen C. Weinbach

Note 1 in this three-part series described how the Federal Reserve (or Fed) implements monetary policy with an ample quantity of reserves in the banking system. There we discussed how the Fed primarily relies on two key administered interest rates to keep the federal funds rate in the FOMC's target range, and why this approach is both appropriate and effective. In this second note, we describe some important influences on the supply of and demand for reserves and how the Fed will need to account for these influences in maintaining an ample quantity of reserves over the long run. These considerations are most relevant in normal times, not in periods in which there are severe strains in financial markets or weakness in economic activity that necessitate aggressive policy actions by the Fed that substantially increase reserves. Note 3 in the series describes how the Fed operates in an ample-reserves regime in such stressed periods, such as the COVID-19 pandemic.

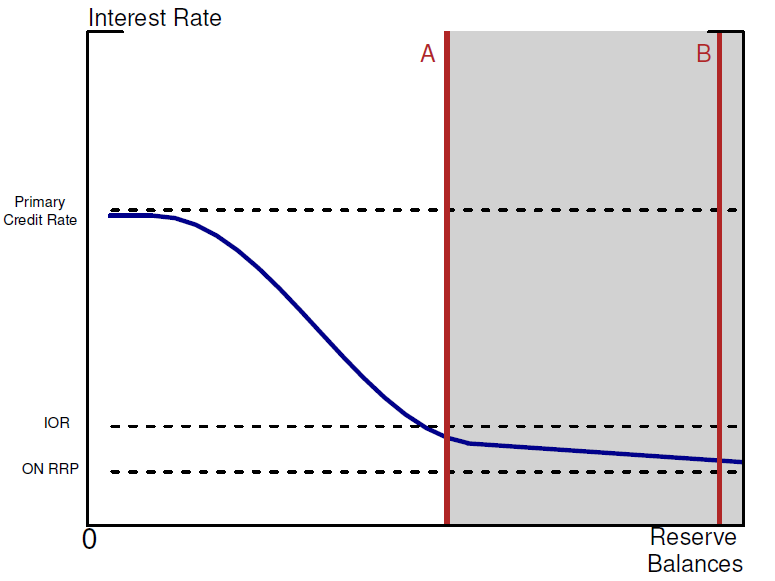

Reserve supply considerations

As illustrated in figure 1, to stay in an ample-reserves regime over time, the Fed needs to maintain a quantity of reserves that is at least as large as the (stylized) quantity "A." But where in the gray shaded region does the Fed seek to maintain reserve supply? The answer is, it depends. Sometimes the Fed temporarily supplies a substantial quantity of reserves—when the Fed judges that it needs to alleviate severe strains in financial markets or stimulate an excessively weak economy, or both—resulting in the supply curve temporarily being positioned very far to the right of "A." This situation happened, for example, as a result of the Fed's actions in response to the Global Financial Crisis of 2007-09 and the COVID-19 shock. But eventually the Fed's unusual policy actions unwind and the level of reserves declines. As reserves decline, the Fed needs to monitor reserve conditions carefully and assess whether it needs to take actions to keep the level of reserves in the gray shaded region. Monitoring is important because factors outside of the Fed's control—referred to as "autonomous factors"—routinely affect the level of reserves over time.

Autonomous factors are liability items on the Fed's balance sheet other than reserves; we will also refer to them as "non-reserve liabilities." Because the activities that result in changes in each of the Fed's non-reserve liabilities clear through reserve accounts at the Fed, the level of reserves in the banking system is directly affected by movements in the autonomous factors. In general, reserves decline dollar-for-dollar with increases in the Fed's non-reserve liabilities, and vice versa. To keep reserve supply amply over time, the Fed must take account of movements in its non-reserve liabilities, both their long-run trend growth and their short-run fluctuations.

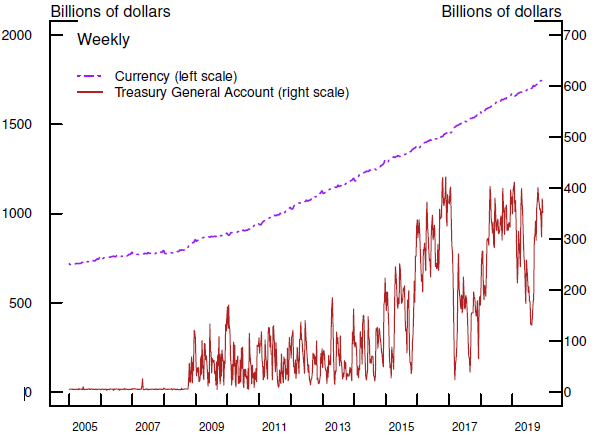

Two key autonomous factors are currency in circulation and the Treasury's cash account, or General Account, at the Fed (the TGA). As shown in figure 2, each of these non-reserve liabilities has grown over time. Such growth causes reserves to decline, all else equal. For example, currency in circulation (the purple broken line) has grown on average about 6 percent a year. When a bank requests currency for its customers, an armored truck comes to a regional Federal Reserve Bank, picks up the cash that was ordered, and delivers it to the ordering bank. The Fed decreases the ordering bank's reserve account to take payment for the cash.

Source: Federal Reserve Board H.4.1 release.

When currency or another non-reserve liability grows, the Fed has to decide if it needs to offset the corresponding decline in reserves. The Fed controls the aggregate quantity of reserves in the banking system through open market operations, or OMOs. When the Fed purchases (sells) some U.S government securities in the open market it increases (decreases) the amount of reserves in the banking system.1 To offset a decline in reserves resulting from growth in its non-reserve liabilities, the Fed would purchase securities in the open market to increase reserve supply. The Fed would conduct a permanent operation (buy securities and hold them to maturity) if it thought a drain in reserves was permanent; it would conduct a temporary OMO (a repurchase agreement or repo) if it thought a drain was temporary.2 Either of these actions would immediately expand the supply of reserves in the banking system, shifting the supply curve in figure 1 rightward within the gray region. Whether the Fed judges it needs to undertake one of these actions or not depends on the original location of the supply curve and the size of the decline in reserves relative to the quantity associated with the vertical line "A." For example, if the supply curve were sufficiently far to the right of "A" when the decline in reserves occurred, an immediate response from the Fed would not be necessary.3

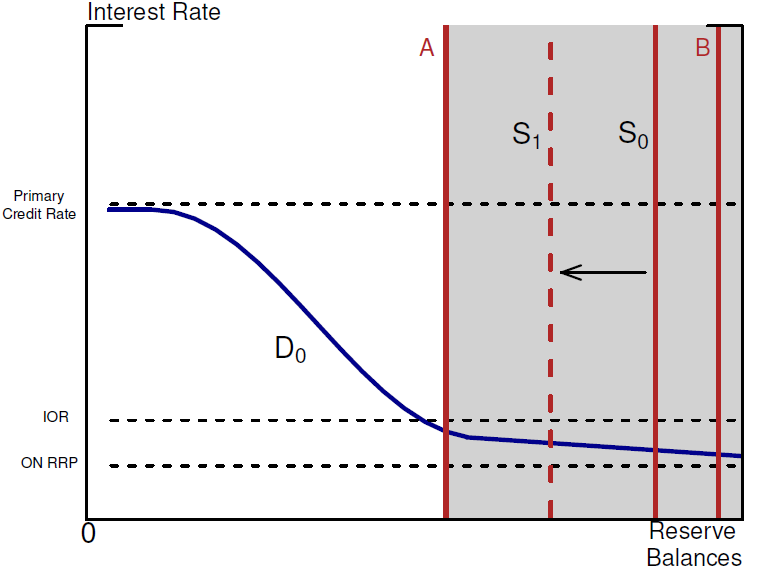

To stay in an ample-reserves regime over the long run, the Fed will eventually need to offset trend growth in the autonomous factors. As noted above, currency has expanded an average of about 6 percent per year, and with more than $1.5 trillion of currency in circulation, such growth amounts to a large dollar increase each year. The TGA (the red solid line in figure 2) has also grown over the past decade, and the size of this account could continue to expand as the nominal value of payment flows managed by the Treasury increases over time. Overall, the long-term growth of these autonomous factors will slowly, and permanently, drain reserves, as illustrated in figure 3 with the leftward shift in the supply curve, from S0 to S1. At some point, when the FOMC judges that it does not want the supply curve to decline further relative to "A," the Fed will need to offset declines in reserves by conducting permanent OMOs, termed "reserve management purchases." For example, when that time has come and if the Fed estimates that its non-reserve liabilities will grow by $10 billion a month, it could purchase $10 billion of Treasury securities each month to inject reserves back into the banking system to keep the quantity of reserves ample.

In addition to their trend growth, non-reserve liabilities also exhibit variability in the short-run. For example, the TGA (red solid line in figure 2) exhibits some substantial fluctuations, typically around tax payment dates for businesses and households. Increases and decreases in the TGA cause reserves in the banking system to fluctuate in the opposite direction—down and up, respectively. Moreover, the degree of variation in the autonomous factors can change over time. In particular, the TGA exhibits much more variability now than prior to the Global Financial Crisis of 2007-09. Taken together, the size of the weekly swings in the autonomous factors over the past few years suggests that, at the extreme, they can cause the quantity of reserves in the banking system to move by about $200 billion from one week to the next.

Over the long run, the Fed needs to consider these short-run movements in the autonomous factors to ensure its supply of reserves remains ample. In particular, the variability of the autonomous factors influences the Fed's judgment about the practical location of the vertical line "A." This is the case because the Fed aims to keep reserve supply large enough to stay consistently in an ample reserves-regime, even when autonomous factors may temporarily cause very large drains in reserves. In addition, given that the behavior of the autonomous factors could evolve over time, the Fed's view of the location of "A" could change going forward.

Reserve demand considerations

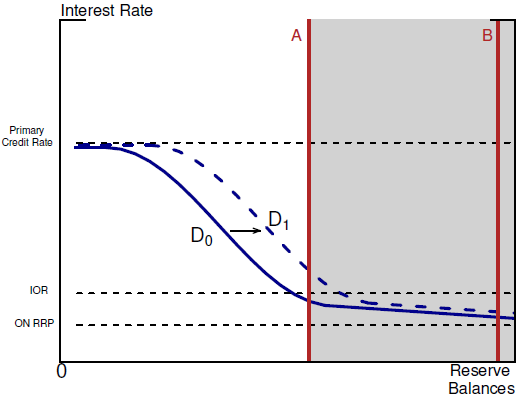

The Fed's judgment about the location of "A" could also change for reasons associated with banks' demand for reserves. For example, suppose banks' preference for holding reserves increased, such as due to heightened perceptions of liquidity risk. Figure 4 illustrates this case, showing a rightward shift in banks' demand curve, from D0 to D1. In this scenario, the vertical line "A" would move to the right along with the outward shift of the demand curve. Would the Fed need to adjust its reserve supply curve in this case? Again, the answer is that it depends. If supply was sufficiently to the right of "A" when the demand shift occurred, the Fed's current quantity of reserves would still be ample and its implementation regime would still work fine. If instead reserve supply was very close to "A" when the demand shift occurred, the Fed would need to add some reserves to the banking system, by conducting OMOs in the form of permanent purchases of securities, to remain in an ample-reserves regime relative to the new position of "A."

Conversely, a development that significantly reduced banks' demand for reserves could arise going forward. For example, a technological change could enable banks to speed the processing of payments and economize on holding cash for operational purposes, or the Fed could introduce a change to its existing policies or tools that leads banks to have a greater preference for investing in non-reserve liquid assets. In such cases, banks' demand for reserves could materially decline, and if so, the demand curve would shift to the left (or inward). Contrary to the case of a rightward shift explained above, in this case the Fed's existing supply of reserves would remain ample.

Final thoughts

To keep operating in an ample-reserves regime over the long run, the Fed will, at some point, likely need to add reserves to the banking system to accommodate ongoing trend growth in its non-reserve liabilities. These open market operations, ceteris paribus, will permanently expand the size of the Fed's balance sheet. The Fed will also need to monitor developments that could necessitate a shift in its assessment of the minimal quantity of reserves needed to stay in an ample-reserves regime. In particular, the Fed will need to watch the behavior of the autonomous factors that affect reserve supply, banks' reserve demand, and other dynamics that might influence the Fed's maintenance of an ample reserve supply as the economy and financial markets continue to evolve. More information about the Fed's ample-reserves implementation regime may be found in Ihrig, Senyuz, and Weinbach (2020), the paper on which Note 1 and Note 2 in this series are based. In Note 3 (forthcoming) in this series, we describe how the Fed operates in an ample-reserves regime when responding to a crisis, such as the COVID-19 pandemic.

References

Ihrig, Jane, Zeynep Senyuz, and Gretchen C. Weinbach (2020). "The Fed's "Ample-Reserves" Approach to Implementing Monetary Policy," Finance and Economics Discussion Series 2020-022. Washington: Board of Governors of the Federal Reserve System, https://doi.org/10.17016/FEDS.2020.022.

Ihrig, Jane E., Lawrence Mize, Gretchen C. Weinbach (2017). "How does the Fed adjust its Securities Holdings and Who is Affected?," Finance and Economics Discussion Series 2017-099. Washington: Board of Governors of the Federal Reserve System, https://doi.org/10.17016/FEDS.2017.099.

1. For more information on how OMOs affect reserves, see Ihrig, Mize, and Weinbach (2017). Return to text

2. When the Fed conducts a repo, it lends cash to the market, temporarily purchases a security from an eligible counterparty, and agrees to sell the security back when the term of the contract ends, receiving the lent cash back plus interest when the transaction unwinds. Each year, the Federal Reserve Bank of New York publishes an annual report of open market operations conducted during the previous year, available at the following link: https://www.newyorkfed.org/markets/annual_reports. Return to text

3. In contrast, in the Fed's previous implementation regime in which reserve supply was substantially more limited—reserve supply was maintained well to the left of quantity "A" in figure 1—the Fed essentially had to immediately offset any declines in reserves caused by an expansion of autonomous factors to maintain control of the federal funds rate. Return to text

Ihrig, Jane, Zeynep Senyuz, and Gretchen C. Weinbach (2020). "Implementing Monetary Policy in an "Ample-Reserves" Regime: Maintaining an Ample Quantity of Reserves (Note 2 of 3)," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, August 28, 2020, https://doi.org/10.17016/2380-7172.2553.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.