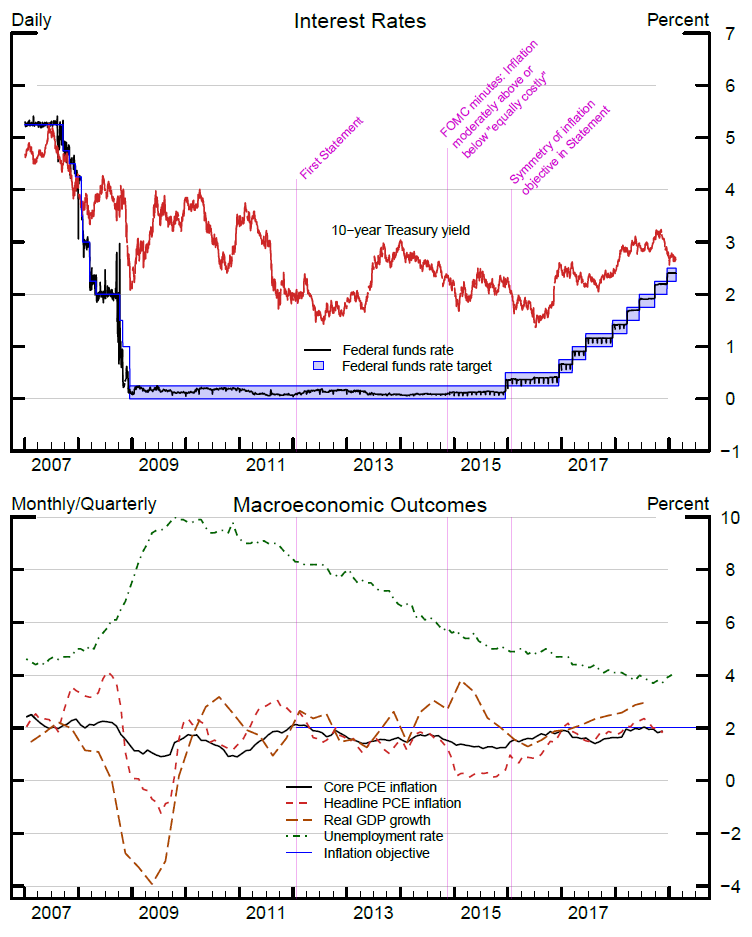

Timelines of Policy Actions and Communications:

Statement on Longer-Run Goals and Monetary Policy Strategy

Since January 2012, the FOMC articulates each January its understanding of its statutory mandate for monetary policy in the Statement on Longer-Run Goals and Monetary Policy Strategy. The Statement establishes that inflation at a rate of 2 percent is most consistent, over the longer run, with the Federal Reserve's statutory mandate. It also describes the FOMC's strategy for achieving maximum employment and 2 percent inflation. These Statements have been released to the public with the FOMC postmeeting statements and have been reproduced in the FOMC meeting minutes.

- January 25, 2012: The FOMC publishes the Statement for the first time alongside its January 2012 postmeeting statement. The inflation objective is stated as follows: "The Committee judges that inflation at the rate of 2 percent, as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve's statutory mandate." The FOMC does not establish a corresponding numeric objective for maximum employment, noting that the factors affecting that maximum level "may change over time and may not be directly measurable."

- November 19, 2014: The minutes to the October 2014 FOMC meeting convey that the FOMC discussed potential revisions to the Statement, noting the existence of "widespread agreement that inflation moderately above the Committee's 2 percent goal and inflation the same amount below that level were equally costly."

- January 27, 2016: The FOMC now refers to its inflation objective as a "symmetric inflation goal" rather than just an "inflation goal." The Statement adds that the Committee "would be concerned if inflation were running persistently above or below this objective."

Sources: FRED, Federal Reserve Bank of St. Louis.

Notes: Headline and core PCE inflation are shown on a 12-month basis. Real GDP growth is shown on a four−quarter change basis. The unemployment rate is on a monthly basis.