May 19, 2016

(Money), Interest and Prices: Patinkin and Woodford

Vice Chairman Stanley Fischer

At "A Conference in Honor of Michael Woodford’s Contributions to Economics" cosponsored by the Federal Reserve Bank of New York, Columbia University Program for Economic Research, and Columbia University Department of Economics, New York, New York

It is an honor for me to speak at the opening of this conference in honor of Michael Woodford, whose contributions to the theory of economic policy are frequently a central part of the economic analysis that takes place in the policy discussions at the Federal Reserve.1

The main story I want to tell today is about the quality of Michael's major book, Interest and Prices (henceforth MWIP). I will start with his predecessors, beginning as Michael does in his Interest and Prices with Wicksell.2 3 I shall quote key points from and about Wicksell's Interest and Prices (henceforth KWIP), and following that, from Patinkin's Money, Interest, and Prices (second edition, 1965) (henceforth MIP), which are relevant to MWIP, Michael Woodford's Interest and Prices (2003).

- Wicksell's Interest and Prices (1898)

- Inflation. The subtitle of Wicksell's Interest and Prices (KWIP) is A Study of the Causes Regulating the Value of Money and its opening paragraph emphasizes the problem of inflation:

Changes in the general level of prices have always excited great interest. Obscure in origin, they exert a profound and far-reaching influence on the whole economic and social life of a country.

Wicksell follows this opening by discussing the difference between the ability of the economic system to adjust to changes in relative prices and to changes in the general level of prices. In the latter case,

Adjustment can no longer proceed through changes in demand or through a movement of factors of production from one branch of production to another. Its progress is much slower, being accomplished under continual difficulties, and it is never complete; so that a residue, either temporary or permanent, of social maladjustment is always left over.

Wicksell states that both inflation and deflation are evils, but that it is generally believed that what is most desirable is a situation "in which prices are rising [italics in original] slowly but steadily" (p.3). He likens the arguments for this viewpoint as reminding one "of those who purposely keep their watches a little fast so as to be more certain of catching their trains" (p.3). Rational man that he was, he dismisses such behavior--of which I am guilty--as not being able to survive in the long run.

And optimist as he must have been, he concludes the opening chapter of his Interest and Prices by saying that "the prevention of these troubles by the provision of a constant measure of value cannot, in the present state of economic development, be regarded a priori as unthinkable" (p.7)

- The Quantity Theory. Wicksell's chapter on the quantity theory is very short. He states (p.41) that

The Theory provides a real explanation of its subject matter, and in a manner that is logically incontestable; but only on assumptions that unfortunately have little relation to practice ...4

He concludes the chapter (p.50) by saying that

the Quantity Theory cannot just be thrown overboard. .... It must be put up with, in the hope that a more intimate analysis of the underlying facts might remove the blemishes from which it undoubtedly suffers.

- The Natural Rate of Interest on Capital and the Rate of Interest on Loans (the cumulative process). We come here to a central and famous part of Wicksell's contribution to monetary economics and policy:

There is a certain rate of interest on loans which is neutral in respect to commodity prices, and tends neither to raise nor to lower them. This is necessarily the same as the rate of interest which would be determined by supply and demand if no use were made of money and all lending were effected in the form of real capital goods. It comes to much the same thing to describe it as the current value of the natural rate of interest on capital. (p.102)

...........

At any moment ... there is a certain level of the average rate of interest which is such that the general level of prices has no tendency to move either upwards or downwards. This we call the normal rate of interest. Its magnitude is determined by the current level of the natural capital rate, and rises and falls with it.

If, for any reason whatever, the average rate of interest is set and maintained below this normal level, no matter how small the gap, prices will rise and will go on rising; or if they were already in process of falling, they will fall more slowly and eventually begin to rise.

If, on the other hand, the rate of interest is maintained no matter how little above the current level of the natural rate, prices will fall continuously and without limit. (p.120)

- International Price Relationships. Wicksell explains in Chapter 10 that while it would be desirable to subject the theory of policy set out immediately above to the test of experience, that could easily be done for a closed economy, but that the only closed economy in the world is the world as a whole--and that world data were not then available.

He then sets out the specie-flow mechanism, and concludes on that subject by saying that while this explanation (the specie-flow mechanism) must be correct, the

international equilibrium of prices is usually restored far more rapidly and far more directly. (p.157)

He then goes on to discuss potential reasons for the more rapid adjustment, the most important of which is that the price pressures on individual commodities that are imported or exported as a result of changes in prices in the two countries exert a direct influence--in the direction of equilibrium--in the prices of individual goods.

- Actual Price Movements in the Light of the Preceding Theory. (Chapter 11) This chapter concludes

The theory must ... be regarded for the moment as a mere hypothesis, the complete validity of which can be established only by further resort to the facts of experience.

...........

My purpose is to lay down the theoretical principles which underlie these phenomena, and once they are correctly understood their application can be confidently left to the experience and insight of practical men. (pp. 176-7)

- Practical Proposals for the Stabilisation of the Value of Money. (Chapter 12). This chapter starts with a discussion of bimetallism, on which Gardlund (p. 274) quotes Wicksell as having written in a letter that he was "neither a mono- nor a bimetallist, but a non-metallist." Wicksell then proceeds to suggest a reaction function for the central bank:

According to our line of approach, they [proposals for stabilizing the value of money] can attain their objective only in so far as they exert an indirect influence on the money rate of interest, and bring it into line with the natural rate ... (p.188)

But

This does not mean that the [central] banks ought actually to ascertain the natural rate before fixing their own rates of interest. ... The procedure should rather be simply as follows: So long as prices remain unaltered, the banks' rate of interest is to remain unaltered. If prices rise, the rate of interest is to be raised. ... and likewise mutatis mutandis if the price level falls. (p.189)

To make this possible, Wicksell suggests the suspension of the free coinage of gold, as a "first step towards the introduction of an ideal standard of value"--"an international paper standard" (p.193). And, on a soaring personal note at the end of the formal text of the book (p.196), he writes

the question of monetary reform on international lines definitely remains among the most important of economic problems. That its realization depends on international co-operation ... is to my mind a positive recommendation. I joyfully welcome every fresh step towards the uniting of nations for economic or scientific ends, for it adds one more safeguard for the preservation and strengthening of that good on which the successful attainment of all other goods, both material and immaterial, ultimately depends--international peace.

If this were a paper about Wicksell, there would be no choice but to stop after this inspiring crescendo. But although Wicksell plays a key role in this paper, the paper is not primarily about him. Let me nonetheless conclude this section of the paper with a few additional comments.

- Wicksell's explanation of price dynamics. (continuation of #1 above)

Now let us suppose that for some reason or other commodity prices rise while the stock of money remains unchanged, or that the stock of money is diminished while prices remain temporarily unchanged. The cash balances will gradually appear to be too small in relation to the new level of prices. ... I therefore seek to enlarge my balance. This can only be done--neglecting for the present the possibility of borrowing, etc.--through a reduction in my demand for goods and services, or through an increase in the supply of my own commodity ... or though both together. The same is true of all other owners and consumers of commodities. But in fact nobody will succeed in realizing the object at which each is aiming--to increase his cash balance. ... On the other hand, the universal reduction in demand and increase in supply of commodities will necessarily bring about a continuous fall in all prices. This can only cease when prices have fallen to the level at which the cash balances are regarded as adequate. ... (pp. 39-40)

- Paul Samuelson on Wicksell. In 1962 Paul Samuelson delivered the Wicksell Lectures in Sweden, and opened with a lecture on "Wicksell, The Economist".5 Herewith three extracts from his lecture:

A stormy rebel against the traditional religion and prudery of his day, Wicksell had the warm heart of a socialist along with the cool head of a classical economist. (pp. 1682-3);

...Wicksell spent part of his time as professor at Lund in jail. Whatever we may think of the state of society then, which could jail a man for the offense of blasphemy, one's admiration goes out to the tradition of academic freedom in Swedish Universities, which keeps a professor's livelihood and scholarly privileges immune from his non-scholarly misdemeanors. (p.1684);

And here comes the essence of Samuelson's evaluation of his great predecessor:

Because Wicksell read the works of his predecessors and contemporaries, and acknowledged the fact; because he was eclectic; because he regarded all his own ideas as merely tentative hypotheses; because he happened to come to economics after Jevons, Menger, Walras, Bohm-Bawerk, Marshall and J.B. Clark--for all these reasons Wicksell is sometimes regarded as not having been a truly original and creative economist. I am convinced this appraisal is quite wrong.

While Wicksell may have lacked the broad judgment of Marshall and one-track concentration of Clark, to savor his genius you have merely to read his works on capital and general equilibrium (vide Joan Robinson); on marginal productivity (vide Solow); on the impact of technological change (vide Hicks); on marginal cost pricing and imperfect competition (vide Hotelling and Chamberlin); on business cycle rhythms generated by uneven exogenous trends and random shocks of innovation, which impinge on an endogenous system geared to produce quasi-regular rhythms whose periods depend on its internal structure (vide Frisch and Tinbergen); on the proper role of government expenditure in an affluent and less-than-affluent society (vide Lindahl and Musgrave); [and] on the relationship between interest rates set by central banks and cumulative trends of inflation or deflation. (p.1688)

What Samuelson saw in 1962 had gradually become the accepted view of Wicksell in the English-speaking world after the translation of both Interest and Prices and the two volumes of his Lectures on Political Economy6 in the 1930s.

And the references by Samuelson to the many topics on which Wicksell made important contributions should remind us that Wicksell's Interest and Prices was but one of his major contributions, and that Volume II of his Lectures on Political Economy is about money, banking and credit.

- Wicksell and Inside Money. In both his Interest and Prices and Volume II of his Lectures, Wicksell discusses the possibility of a pure inside money economy. His conclusion is stated with his usual clarity:

Only by completely divorcing the value of money from … its commodity function, by abolishing all free minting, and by making the minted coin or banknotes proper, or more generally the unit employed in the accounts of the credit institutions, both the medium of exchange and the measure of value, only in this way can the contradiction be overcome and the imperfection be remedied. It is only in this way that a logically coherent credit system, combining both economy of monetary media and stability in the standard of value, becomes in any way conceivable.

- Inflation. The subtitle of Wicksell's Interest and Prices (KWIP) is A Study of the Causes Regulating the Value of Money and its opening paragraph emphasizes the problem of inflation:

- Patinkin's Money, Interest, and Prices (first edition, 1956; second edition, 1965)7

In discussing Patinkin's work, I need to mention that I was his research assistant when he visited MIT in about 1967-8, and that I was an admirer of his work and of his reputation as the founder of modern Israeli economics, and that later I became his friend, albeit a junior among friends. Now I turn to his major work.

- The goal of MIP. The subtitle of MIP is An Integration of Monetary and Value Theory. Its goal was thus more theoretical than the goals of either of the Interest and Prices volumes. The need for such an integration was based on the view, frequently expressed by graduate students, that the field of macroeconomics was based on ad hoc assumptions rather than being derived from first principles, as is done in value theory--that is, microeconomics.

The first paragraph of the introduction to both editions of MIP is

Money buys goods, and goods do not buy money. The natural place, then, to study the workings of monetary forces is directly in the market for goods. This will be our central theme.

- The real balance effect. MIP builds the integration of monetary and value theory around the real balance effect, often known as the Pigou effect, the presence of a wealth effect in aggregate demand, which produces stable price dynamics at the level of the aggregate economy. The first edition was published in 1956 and became very well known, but was also criticized, particularly about the dynamics of prices in response to changes in the money stock. The second edition, published in 1965, responded to this and other critiques, and achieved the goal set out in the book's subtitle.

In Note M of MIP (pp. 651-664) Patinkin reviews empirical investigations of the real-balance effect, noting that most of the studies are in effect estimates of the impact of liquid wealth holdings, rather than just real balances, on consumption.

-

Reviews of the book. In an article published in 1993 in a festschrift for Patinkin8, I reviewed both editions of MIP.The book had been reviewed by at least twelve reviewers, whose verdicts were largely favorable, with almost all recognizing that they were dealing with a major work.

-

Supplementary Notes. MIP includes excellent "Supplementary Notes and Studies in the Literature" including on the work of Walras (Notes B and C), Wicksell (Note E), of whom like almost all who studied him became admirers, on Newcomb, Fisher and the Transactions Approach to the Quantity Theory (Note F), Marshall, Pigou and the Cambridge Cash-Balance Approach (Note G), Monetary Aspects of the Casselian System (Note H), The Classical and Neoclassical Theory of Money and Interest (Note J), and Keynes' General Theory (Note K). In his review of MIP, Kenneth Arrow9 described the literature notes as "sparkling"--not a word frequently used in such a context.

-

Harry Johnson's comments. In his 1962 review article on recent work on monetary theory and policy,10 Harry Johnson devoted almost a quarter of the review to MIP, which he described as "monumentally scholarly", but argued that its analysis of the real balance effect was "conceptually inadequate and crucially incomplete".11

Johnson (1962) argued further that

... the more elegant approach to monetary theory lies along inside-money rather than outside-money lines, and that the foundation of the theory of monetary equilibrium and stability should be the substitution effect rather than the ... wealth effect of a change in real balances.

Possibly Johnson was thinking of the central bank having to operate via open-market operations, through exchanges of assets, which would induce substitution effects, rather than through the printing of money, which in the first instance produced increases in real balances, which would produce wealth effects, but which are typically fiscal rather than monetary actions.

-

Involuntary unemployment. Chapters 13 and 14 of MIP deal with the consumption function when unemployment takes the household off its labor supply curve, and with other interactions between markets. They are based on research by Leijonhufvud and Clower, and do an excellent job of clarifying the implications of disequilibrium in one market for behavior in other markets. This approach was developed further by Robert Barro and Herschel Grossman in their 1976 volume, Money, Employment, and Inflation, but began to go out of use and fashion in the 1980s.12

-

Surprising omissions. MIP definitely achieves its goal of integrating monetary and value theory, but shows signs of its age in two omissions: first, that expectations are not emphasized and indeed barely discussed; and second, there is no analysis in MIP of ongoing inflation--the latter omission being particularly striking given Israel's inflationary history.

- The goal of MIP. The subtitle of MIP is An Integration of Monetary and Value Theory. Its goal was thus more theoretical than the goals of either of the Interest and Prices volumes. The need for such an integration was based on the view, frequently expressed by graduate students, that the field of macroeconomics was based on ad hoc assumptions rather than being derived from first principles, as is done in value theory--that is, microeconomics.

- Michael Woodford's Interest and Prices (2003)

Now we come to modern times, to Michael Woodford's 2003 magnum opus, Interest and Prices. Many of the results that appear in the book were developed and published earlier, for Michael has been a creative and insightful researcher from the start of his career. But in the interests of time, I will start with the book. And since the book is massive and comprehensive, I will focus on just a few topics of interest selected from it. I also add discussion of Michael's views on quantitative easing and forward guidance--topics that would have received far more attention in MWIP if it had been written a decade later than it was. And let me note explicitly that Michael has continued to be remarkably productive, and that the topics I focus on below are among those best known by modern macroeconomists, but that there is far more to be learned from reading Michael's work than I am able to discuss today.

-

The Structure of MWIP. Interest and Prices (MWIP) is divided into two parts. Part I, Analytic Framework, is essentially an advanced textbook on modern macro models and some of their monetary policy implications, which introduces the reader to both useful techniques of analysis and recurrent and important issues in the field. Its chapter headings are: Price-Level Determination under Interest Rate Rules; Optimizing Models with Nominal Rigidities; A Neo-Wicksellian Framework for the Analysis of Monetary Policy; and Dynamics of the Response to Monetary Policy. Part II, Optimal Policy, is more directly policy-focused, with chapter headings: Inflation Stabilization and Welfare; Gains from Commitment to a Policy Rule; and finally, Optimal Monetary Policy Rules.

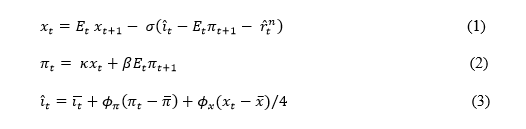

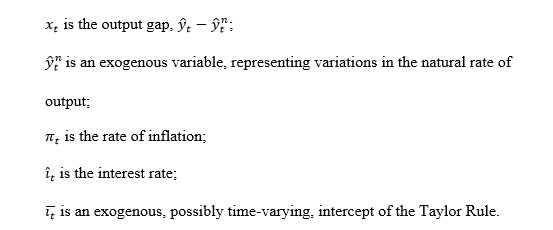

- The basic model. MWIP is innovative and impressive. In almost every analysis, it uses a small DSGE model, with variations in assumptions to deal with the topic in hand. Here follows a typical three equation model, consisting of log-linear approximations of the non-linear equilibrium conditions of an underlying model that includes an intertemporal Euler equation, a New Keynesian Phillips curve, and an interest rate rule.13

where

-

Analyzing Monetary Policy without Money. One of Woodford's most interesting results is that it is often possible to study monetary policy without having money in the model. In these cases, monetary policy is conducted using the interest rate as the monetary policy instrument. As Woodford notes in Chapter 4, "A Neo-Wicksellian Framework", a money demand equation can under some circumstances be added to the model, with the amount of money supplied by the central bank having to be consistent with the money demand equation. But inflation in such a situation is not necessarily caused by the quantity of money; rather the quantity of money may be caused by and consistent with the inflation rate resulting from the three basic equations in which the money stock does not appear--in particular from the gap between the natural and actual rates of interest. For this result to go through, the money stock cannot per se be among the variables that determine the equilibrium of the remaining--the non-monetary--part of the model. This means that the separation result is not possible if there is a real balance effect operating in the goods markets. Or to put the result differently, the separation feature is consistent with an inside money monetary system, while it may well not be consistent with an outside money structure. It is thus consistent with the suggestion by Harry Johnson mentioned above, that monetary analysis might better be carried out primarily in an inside-money than an outside-money model.

This neo-Wicksellian result is somewhat surprising. It provides justification for the behavior of those central banks that think and talk of monetary policy purely in terms of the policy interest rate and other financial return variables, but not of the money stock. However, we need to remind ourselves that it is built on an assumption that the money stock per se does not appear in the basic three-equation model--and that is an assumption, not a theorem.14

-

The Goals of Policy. When he turns to optimal policy, Woodford starts Chapter 6 by asking what the goals of monetary policy should be. He states that there is a fair amount of consensus in the literature that a desirable monetary policy is one that achieves a low expected value of an objective function that includes inflation and "some measure of output relative to potential." He then goes on to point out the many questions such a formulation leaves unanswered, including whether to target the price level or the inflation rate, should greater priority be given to reducing the variability of unforecastable inflation, should one seek to stabilize output deviations from a smooth trend or from the short-run aggregate supply curve, and so forth? And then the surprising comment (p.382)

The aim of the present chapter is to show how economic analysis can be brought to bear upon these questions.

This sounds simple but it is not, for the explanation that Woodford provides is that

we have seen that models founded on individual optimization can be constructed that, thanks to the presence of nominal rigidities, allow for realistic effects of monetary policy upon real variables. Here we shall see those same nominal rigidities provide welfare-economic justification for central bankers' traditional concern for price stability.

That is not a simple thought, but it is logical--and that insight enables Michael to derive a utility or loss function with inflation in it.

Interestingly, Woodford recognizes that his result is based on several approximations (pp. 383-392), but is nonetheless prepared to go ahead. While that choice is to some extent a matter of taste, it is also highly pragmatic--and some might say, a reflection of his MIT training, a comment that I would take as a compliment.

-

The importance of the long-term interest rate. Another key result is that when you solve forward the system above, you find, as Woodford notes (p.244), that

aggregate demand in this model depends upon all expected future short real rates, and not simply upon a current ex ante short real rate of return; and unless fluctuations in short rates are both highly unforecastable and highly transitory, expectations of future short rates are more significant than the current short rate

--and in a footnote he notes that this can also be explained by saying that it is the long rate of interest and not the short rate that determines aggregate demand in this model.

-

What to do at the ZLB, Forward Guidance, The Role of Expectations. MWIP was completed well before the Fed had to contend with the ZLB--zero lower bound--which later became the ELB--effective lower bound--even though there were discussions in the U.S. economy in 2003 and earlier about what to do if the economy were ever to be at the ZLB.15

Woodford's views on forward guidance can be understood from the discussion above of the forward solution of the basic model. Woodford has long emphasized the importance of policy commitment, even in the absence of a binding ZLB constraint. At the ZLB, explicit forward guidance can potentially offset a lot of the distortion, by, in effect, reducing all interest rates across the maturity spectrum at least up to the time that policy changes. Indeed, as shown by Eggertson and Woodford (2003), optimal forward guidance should commit to maintain lower interest rates during the recovery than would otherwise have been warranted by economic conditions.16 Importantly, the appropriate commitment can be framed as a history-dependent policy function responding only to the history of the price level and the output gap, in such a way that the impact on policy decisions of economic conditions at the lower bound continue, even as the economy recovers.

A history-dependent policy rule introduces a wedge between what the central bank has promised and what contemporary circumstances, taken by themselves, would call for. This wedge may raise difficult questions regarding the credibility of the policy. Woodford believes that credibility can be enhanced by spelling out an explicit framework describing the nature of any history-dependence. For example, as Woodford suggests in his 2012 Kansas City Fed paper,

A more useful form of forward guidance, I believe, would be one that emphasizes the target criterion that will be used to determine when it is appropriate to raise the federal funds rate target above its current level, rather than estimates of the "lift-off" date. If such an explicit criterion made it clear that short-term interest rates will not immediately be increased as soon as a Taylor rule descriptive of past behavior would justify a funds rate above 25 basis points, this would provide a reason for market participants to expect easier future monetary and financial conditions than they may currently be anticipating ...

The very powerful effects of forward guidance have been called "the forward guidance puzzle". But the puzzle is not a deep one, for the ability of any central bank to commit to follow a particular monetary policy rule must be a diminishing function of the length of the horizon that is being considered. This fact serves to limit the extent to which policy can deliberately shape private expectations. However, the strength of forward guidance is just one manifestation of a very high interest elasticity in the DSGE models typically used by Woodford that shows up pervasively. For example, any combination of shocks that brings the economy to the ZLB for an appreciable length of time will display the effects of the elevated interest elasticity in such models, whether or not the central bank is assumed to issue explicit forward guidance. This high elasticity is also in evidence in attempts to evaluate alternative monetary policy regimes.17

-

What to do at the Lower Bound, Quantitative Easing. Woodford is much less impressed by the potential power of quantitative easing (or "targeted asset purchases" as he describes them in his Jackson Hole paper). He argues that portfolio balance effects do not exist in a modern, general-equilibrium theory of asset prices, and that it does not matter whether a particular risk is held in the portfolio of private investors or the central bank, for in the end the gains or losses of the central bank are transferred to the government, and via the government budget constraint, are returned to private individuals. This is Ricardian equivalence in a slightly different context than examined by Robert Barro.18

Whether it applies in practice is an empirical issue, with empirical evidence from many papers written in the Fed and elsewhere suggesting a significant impact in the expected direction from quantitative easing actions undertaken by the Fed and other central banks.19

-

Money Supply versus Interest Rate. At present, the Neo-Wicksellian approach developed by Woodford and others is dominant, relative to the explicitly monetary approach to monetary policy used by Patinkin and others. I suspect this situation will continue. But I believe that we need to consider both approaches to monetary policy, for monetary policy affects the economy not only through the Euler equation as in Woodford, but also through direct effects on current demands for goods described by Patinkin's use of the real-balance effect and by Wicksell's explanation of price dynamics described earlier.

-

The fundamental impact of Michael Woodford on Fed thinking:20 The most direct impact of Woodford on Fed thinking and analysis comes from his neo-Wicksellian analysis of monetary policy. Essentially, Woodford has developed the links between fluctuations of output and inflation around their natural21 or long-run equilibrium values and economic welfare--a point22 made clear by the discussion above of his analysis of the optimal goals of monetary policy.

Many Fed researchers--among them more than a dozen Woodford students--have attempted to measure the natural rates of interest and the natural output gap. Early work on these topics using DSGE models produced very volatile estimates of these concepts, leading to the development of DSGE models with more realistic features, including important roles for financial frictions, which fit the data better--and which bear some resemblance to more traditional estimates of the output gap. As a result, these models are now routinely used in monetary policy discussions.

One key lesson from these models is that measuring the natural rate of interest or the output gap is hard. However, estimates of the natural rate of interest from a collection of structural models across the Federal Reserve System indicate that the natural rate fell considerably during the financial crisis, became quite negative in its aftermath, and has subsequently recovered only slowly.23

While estimates of the natural rate from DSGE models provide some information needed for the proper conduct of monetary policy, these estimates are closely tied to the structure of the DSGE models, and essentially ignore the possibility of long-term structural changes in the balance between saving and investment. As a result, an alternative longer-run concept, the equilibrium rate of interest, has also played an important role in recent policy discussions. Estimates of this concept, which follow a statistical approach introduced by Thomas Laubach and John Williams24, have also fallen to quite low levels.

A priority for researchers in the field is to develop improved estimates of the long-run equilibrium interest rate, and to develop policies that can influence it. In that regard, one should recognize that in a more complete model than the basic three equation model laid out above, the natural and long-run equilibrium interest rates would be functions of many variables, among them fiscal variables--with respect to both infrastructure spending and taxation. In particular, faster trend growth would increase the long-run equilibrium interest rate, and what we need most, now that we are near full employment and approaching our target inflation rate, is faster potential growth. The neo-Wicksellian and Woodfordian approach to macroeconomics is well suited also to study that problem, which is critical to the future of the United States and global economies.

-

1. I am grateful to Hess Chung, Rochelle Edge, William English, Michael Kiley, Thomas Laubach, Matthias Paustian, David Reifschneider, Jeremy Rudd, and Stacey Tevlin of the Federal Reserve Board for their advice and assistance. Return to text

2. Wicksell's Interest and Prices, published in German in 1898 as Geldzins und Guterpreise by Gustav Fischer (Jena), was first published in English (translated by R.F. Kahn) by Macmillan & Co. in 1936. It was published in the United States by Augustus Kelley in 1965 in the series Reprints of Economic Classics. Return to text

3. See Torsten Gardlund (1958), The Life of Knut Wicksell, trans. Nancy Adler (Brookfield, Vt.: Edward Elgar). Wicksell was not only a superb economist but also a remarkably interesting man, whose major works in economics were published starting in the late 1890s, when he was nearing the age of 50 (he was born in 1851 and died in 1926). Much of his earlier work was on Malthus and Malthusianism. The last paragraph of the text of Gardlund's book (p. 330) is about Wicksell's funeral and reads "Various associations and academic institutions sent the customary wreaths, but many of Wicksell's friends and disciples, honoring a request, instead sent their contributions to the Malthusian Advice Bureau." Return to text

4. He gives several reasons that the assumptions have little relation to practice, including that there is "a kind of collective holding of balances, arising out of the acceptance by banks of deposits." Return to text

5. See Joseph E. Stiglitz, ed. (1966-2011), The Collected Scientific Papers of Paul Samuelson, vol. II (Cambridge, Mass.: MIT Press), pp. 1682-92. Return to text

6. See Knut Wicksell (1935), Lectures in Political Economy, vol. I: General Theory and vol II: Money (London: George Routledge and Sons); reprinted in 1967 (Fairfield, N.J.: Augustus M. Kelley). Return to text

7. The first edition of Money, Interest, and Prices was published in 1956 by Row, Peterson (Evanston, Ill.); the second edition in 1965 by Harper & Row (New York). Return to text

8. See Stanley Fischer (1993), "Money, Interest, and Prices" in Haim Barkai, Stanley Fischer, and Nissan Liviatan, eds., Monetary Theory and Thought: Essays in Honour of Don Patinkin (London: Palgrave Macmillan). Return to text

9. See Kenneth J. Arrow (1957), "Review of Money, Interest, and Prices," Mathematical Reviews, vol. 18 (September). Return to text

10. See Harry G. Johnson (1962), "Monetary Theory and Policy," American Economic Review, vol. 52 (June), pp. 335-84. Return to text

11. As noted in my 1993 article, I did not find that criticism compelling. Return to text

12. See Robert Barro and Herschel Grossman (1976), Money, Employment and Inflation (New York: Cambridge University Press). Return to text

13. These are equations (1.12), (1.13), and (1.14), respectively, in chapter 4, which appear on page 246 of MWIP, the derivation of which is discussed on pp. 243-45. Return to text

14. It is worth noting that the money stock dropped out of many models in the 1980s because standard relationships between money and real variables became unstable and because money aggregates became difficult to control. Or, as Gerald Bouey, former governor of the Bank of Canada, once said to the House of Commons Standing Committee on Finance, Trade and Economic Affairs, "We did not abandon M1, M1 abandoned us." Return to text

15. See Michael Woodford (2012), "Methods of Policy Accommodation at the Interest-Rate Lower Bound," in Proceedings--Economic Policy Symposium--Jackson Hole (Kansas City: Federal Reserve Bank of Kansas City), pp. 185-288. Return to text

16. See Gauti B. Eggertsson and Michael Woodford (2003), "The Zero Bound on Interest Rates and Optimal Monetary Policy," Brookings Papers on Economic Activity, no. 1, pp. 139-211. Return to text

17. I am grateful to Hess Chung of the Federal Reserve Board for drawing to my attention the general point made in this paragraph. Return to text

18. See Robert J. Barro (1974), "Are Government Bonds Net Wealth?" Journal of Political Economy, vol. 82 (November-December), pp. 1095-1117. Return to text

19. See Joseph E. Gagnon (2016), "Quantitative Easing: An Underappreciated Success ," Policy Brief 16-4 (Washington: Peterson Institute for International Economics, April). Return to text

20. I draw here on notes provided by Michael Kiley of the Federal Reserve Board. Return to text

21. In Woodford's and Wicksell's analyses, natural values are those that would prevail in the absence of nominal rigidities. Return to text

22. See, for example, Katharine Neiss and Edward Nelson (2002), "Inflation Dynamics, Marginal Cost, and the Output Gap: Evidence from Three Countries," unpublished paper, Bank of England, July; Rochelle Edge, Michael Kiley, and Jean-Philippe Laforte (2008), "Natural Rate Measures in an estimated DSGE model of the U.S. economy," Journal of Economic Dynamics and Control, vol. 32, pp. 2512-35. Return to text

23. See, for example, figure 1 in Janet Yellen (2015), "The Economic Outlook and Monetary Policy," speech delivered at the Economic Club of Washington, Washington, D.C., December 2. Return to text

24. See Thomas Laubach and John Williams (2003), "Measuring the Natural Rate of Interest," Review of Economics and Statistics, vol. 85, pp. 305-25. Return to text