Currency Print Orders

2026 Federal Reserve Note Print Order

The Board of Governors, as the issuing authority for Federal Reserve notes, approved and submitted its calendar year (CY) 2026 print order to the U.S. Department of the Treasury’s Bureau of Engraving and Printing (BEP) on July 15, 2025. The CY 2026 print order ranges from 3.8 billion to 5.1 billion notes, valued at $108.9 billion to $139.6 billion. During CY 2026, Board and BEP staff may adjust production of each denomination to best match demand throughout the year.

The print order reflects the Board’s estimate of net demand for currency from domestic and international customers for CY 2026. It was determined by several factors, including forecasted currency inventory volumes, destruction rates of unfit notes, and trends in net payments.1 Additionally, the CY 2026 print order demonstrates a shared commitment between the Board and BEP to allocate BEP’s production capacity to essential projects that support the U.S. Currency Program’s strategic priorities. These priorities include development testing, completion of banknote series changes, installation of new equipment, and work on projects to improve manufacturing efficiency.

The table below shows the denominational breakdown of the CY 2026 print order and the range of notes planned for each denomination.

| Denomination | Print Order (000s of pieces) | Dollar value (000s) |

|---|---|---|

| $1 | 1,299,200 to 1,440,000 | $1,299,200 to $1,440,000 |

| $2 | 0 to 0 | $0 to $0 |

| $5 | 390,400 to 448,000 | $1,952,000 to $2,240,000 |

| $10 | 102,400 to 563,200 | $1,024,000 to $5,632,000 |

| $20 | 1,081,600 to 1,568,400 | $21,632,000 to $31,368,000 |

| $50 | 144,000 to 224,000 | $7,200,000 to $11,200,000 |

| $100 | 758,400 to 876,800 | $75,840,000 to $87,680,000 |

| Total | 3,776,000 to 5,120,400 | $108,947,200 to $139,560,000 |

The CY 2026 print order ranges from 3.8 billion to 5.1 billion notes. The lower range of the order is a decrease of about 0.3 billion notes, or 8.2 percent, from the lower range of the CY 2025 print order. The upper range of the order is a decrease of about 0.8 billion notes, or 13.3 percent, from the upper range of the CY 2025 print order.

Currency in circulation, a direct measure of demand for Federal Reserve notes, increased by 0.8 billion notes, or $43.1 billion dollars, between June 2024 and June 2025. In contrast, over the same period the previous year, currency in circulation increased by 0.2 billion notes, or $7.1 billion dollars. Year over year, currency in circulation continues to increase though the rate at which it is increasing has fallen below pre-pandemic levels.

Appendix

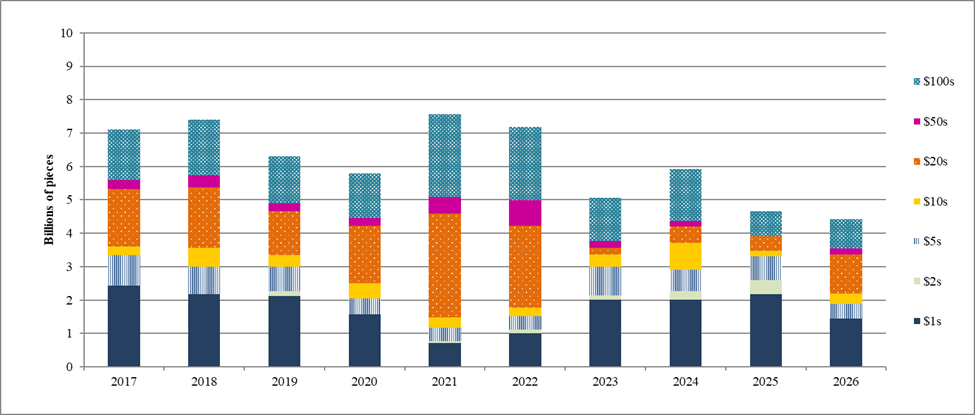

Chart 1

Historical Print Orders

Note: Starting in FY 2021, the print order was submitted as a range by denomination. The bars for FY 2021 and onward represent the number of banknotes the BEP committed to deliver in its respective fiscal year. Years before 2024 use the Federal fiscal year (October – September); 2024 and onward use the calendar year (January – December).

Footnotes

1. Unfit notes are notes that are received in deposits from depository institutions that are destroyed because they do not meet the Federal Reserve's quality criteria for recirculation. Return to text.