How Federal Reserve Supervisors Do Their Jobs

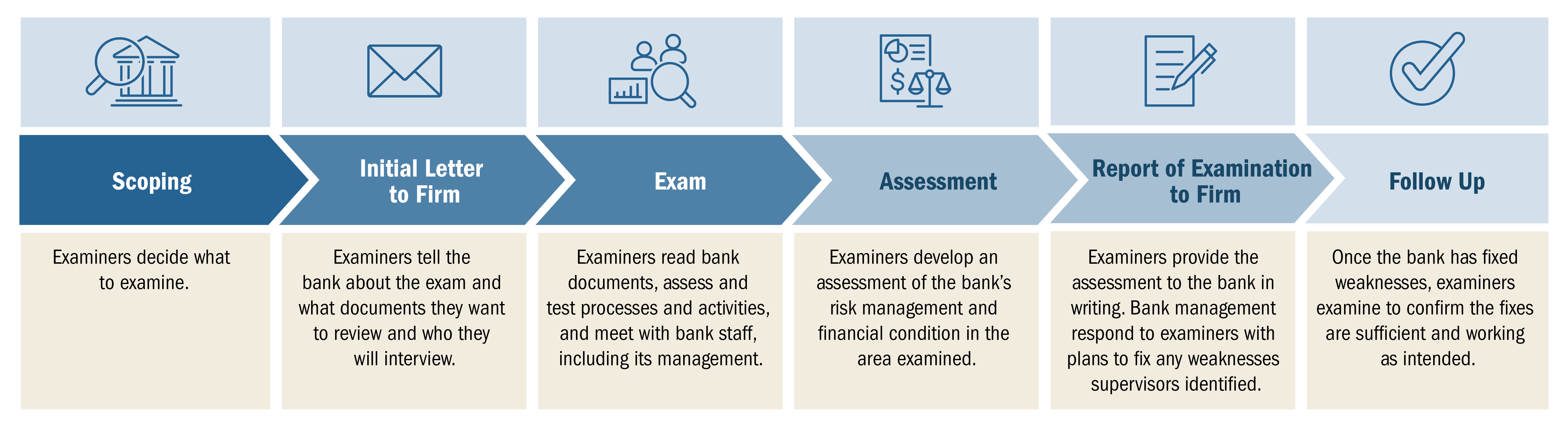

The primary way supervisors, also known as examiners, do their job is through bank examinations (see figure 1). An examination is a review and evaluation of a bank's activities, risk management, and financial condition. Bank examinations result in assessments that are reported to the bank in writing. Examiners decide what to examine at banks, mostly based on the bank's known and potential risks. Some examinations are also required by law.

What is a report of examination?

The report of examination explains the bank examiners' assessment about how well the bank manages risk in the areas reviewed in the exam and whether the bank has sufficient financial resources. If examiners find a bank's risk management or financial resources to be insufficient, examiners provide direction and require the bank to correct its weaknesses. This direction takes the form of confidential supervisory findings: "Matters Requiring Attention" (MRAs) and for more significant issues that must be corrected on a priority basis, "Matters Requiring Immediate Attention" (MRIAs).

It is the responsibility of the bank's management to fix the weaknesses, and it is the responsibility of the examiners to evaluate the adequacy of those fixes.

It is important to have this written record of supervisory direction so that if a bank does not fix its weaknesses, examiners can build a case for an enforcement action (see "What happens when a bank does not respond to supervisory findings from examiners?").

What is an MRA and an MRIA and what are the differences?

An MRA requires a bank to take action to address weaknesses that could lead to deterioration in the bank's safety and soundness; an MRIA requires a bank to take immediate action on a priority basis, to address important or lingering weaknesses that could lead to further deterioration in the bank's safety and soundness.

The Federal Reserve regularly publishes information about its supervisory findings, including MRAs and MRIAs, in its semiannual Supervision and Regulation Report (in the section on "Supervisory Developments)."2

How do examiners know if a bank fixes its weaknesses?

Typically, examiners conduct an examination to review the actions the bank has taken and assess whether those actions will fix the weakness. Supervisory findings generally provide a description of the weakness and criteria examiners will use to assess whether the weakness has been fixed.

For example, an MRA or MRIA may require a firm to take extra steps to limit risks while the weakness is being fixed. When examiners identify new weaknesses, they issue new supervisory findings.

What are supervisory ratings?

Supervisory ratings provide an assessment of a bank's risk management and financial condition, based on examination results, supervisory findings, and other information gathered throughout the year. They reflect examiners' overall judgment of the bank's safety and soundness.

Supervisory ratings are generally issued once a year for larger banks and every 18 months for smaller banks (see table 2 for how banks are examined throughout the year).

What happens when a bank does not respond to supervisory findings from examiners?

If a bank does not address supervisory findings, examiners may take actions such as lowering the bank's supervisory rating, or the Federal Reserve may pursue an enforcement action against the bank.