Understanding Enforcement Actions

The Federal Reserve may escalate beyond supervisory findings and other tools and pursue an enforcement action if a bank has engaged in an unsafe or unsound practice or violated the law.

Do enforcement actions vary?

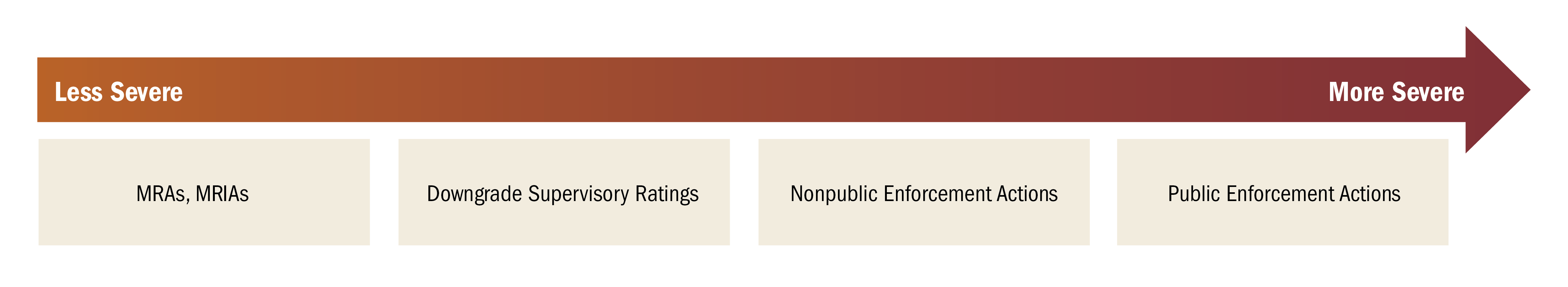

Yes, the severity of an enforcement action can vary, depending on the nature of the concern or violation of law. If a weakness requires a more detailed resolution or is more pervasive at a bank, the Federal Reserve may enter into a memorandum of understanding (MOU) with the bank, in which the board of directors and/or firm management commits to taking specific actions to fix its weaknesses. MOUs are nonpublic enforcement actions.

A public enforcement action can be issued to compel the management and directors of a bank to address its weaknesses. Many factors are considered in determining whether a public action is appropriate, including the nature, severity, and duration of the bank's weaknesses; the financial condition of the bank; and whether the bank has failed to comply with prior directives to correct its weaknesses whether through MOUs, supervisory findings, or both. As described below, enforcement actions may also impose fines and restrictions on banks.

What if a bank has an enforcement action but still does not fix its weaknesses?

In these cases, more severe actions can be taken, such as imposing limits on certain bank activities or requiring it to conserve or increase its financial resources. For example, if a bank is experiencing weaknesses in its financial condition, a public enforcement action can be issued that prohibits the bank from paying dividends to shareholders or requires it to increase capital or improve its liquidity position. Fines can also be imposed as part of a public enforcement action (see figure 2).

How does an enforcement action force a bank to do something? Does it have to agree?

Most enforcement actions are issued upon agreement with the bank. When banks refuse to agree, the Federal Reserve Board can bring the matter to a judge in a process that includes a public hearing.