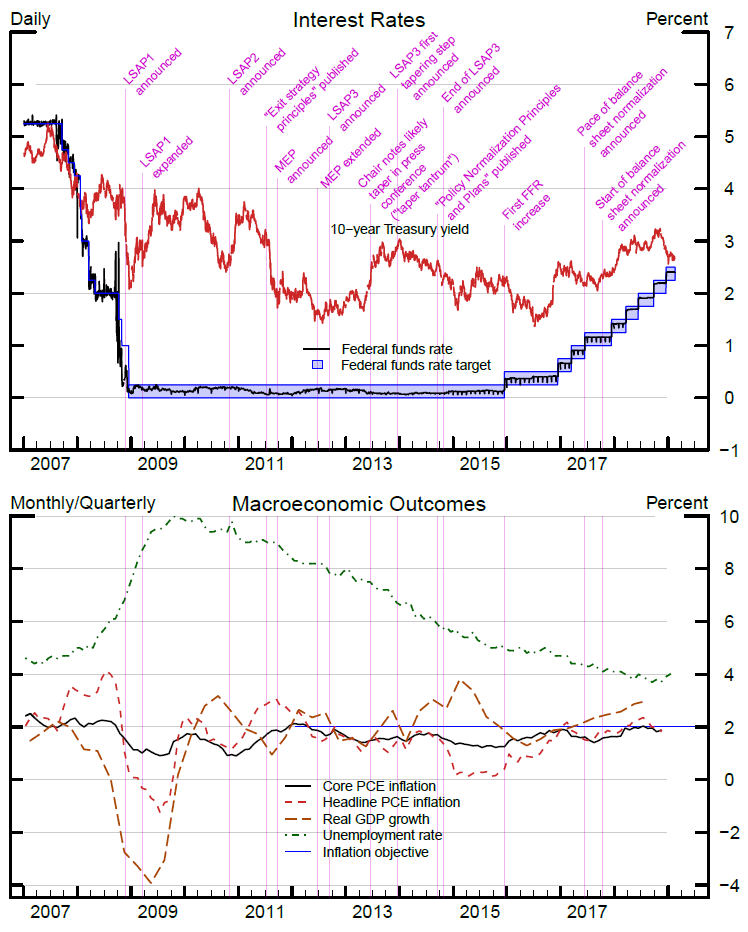

Timelines of Policy Actions and Communications:

Balance Sheet Policies

In the aftermath of the Global Financial Crisis, the Federal Reserve purchased longer-term securities issued by the U.S. government and longer-term securities issued or guaranteed by government-sponsored agencies such as Fannie Mae or Freddie Mac. These purchases put downward pressure on the longer-term interest rates faced by households and businesses, thereby encouraging spending and investment and a return of inflation to 2 percent. The list below encompasses the Federal Reserve's announcements and actions that affected the size and composition of the Federal Reserve's balance sheet. These announcements and actions pertain to the Federal Reserve's three large-scale asset purchase (LSAP) programs, its maturity extension program (MEP), and its policy regarding the reinvestment of principal from maturing securities held in the System Open Market Account.

- November 25, 2008: The Federal Reserve announces its intention to purchase up to $100 billion of agency debt securities and up to $500 billion of agency mortgage-backed securities (MBS). These purchases (henceforth "LSAP1") are to be completed "over several quarters."

- March 18, 2009: The FOMC expands LSAP1 to a total of $1.25 trillion in MBS, $200 billion in agency debt securities, and $300 billion in longer-term Treasury securities. The purchases are to be completed by the end of 2009.

- August 10, 2010: The FOMC states that it will keep constant the Federal Reserve's holdings of securities at their current level "by reinvesting principal payments from agency debt and agency [MBS] in longer-term Treasury securities" and by continuing to roll over its holdings of Treasury securities as they mature.

- September 21, 2010: The FOMC emphasizes in its postmeeting statement that it is "prepared to provide additional accommodation if needed to support the economic recovery and to return inflation, over time, to levels consistent with its mandate."

- November 3, 2010: The FOMC announces a second LSAP program (henceforth "LSAP2"), stating that it will purchase an additional $600 billion in longer-term Treasury securities at "a pace of about $75 billion per month." The program is to be completed by the second quarter of 2011.

- September 21, 2011: The FOMC announces a maturity extension program (MEP) under which it will sell a total of $400 billion in Treasury securities with a remaining maturity of 3 years or less and use the proceeds to buy $400 billion in Treasury securities with a remaining maturity of 6 to 30 years. The transactions are to be completed by the end of June 2012. In addition, the FOMC announces that it "will now reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in agency [MBS]" while maintaining its policy of rolling over maturing Treasury securities.

- June 20, 2012: The FOMC states that it will extend its ongoing MEP through the end of 2012 by continuing to purchase longer-term securities at the current pace of about $45 billion per month, while simultaneously selling or redeeming corresponding amounts of shorter-term Treasury securities.

- September 13, 2012: The FOMC announces its third LSAP program (henceforth "LSAP3"), which consists of open-ended purchases of $40 billion per month in MBS. In conjunction with the ongoing MEP, the announcement implies increases in the Federal Reserve's holdings of longer‐term securities of about $85 billion per month. The FOMC statement also indicates that if the outlook for the labor market does not improve substantially, it will continue its purchases of agency MBS, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability. The Committee further notes that in determining the size, pace, and composition of these purchases, it will take appropriate account of their "likely efficacy and costs."

- December 12, 2012: The FOMC announces that, after the MEP ceases at the end of the year, it will purchase longer-term Treasury securities at a pace of $45 billion per month, thereby continuing to purchase longer-term securities at a pace of about $85 billion per month.

- March 20, 2013; May 1, 2013: The FOMC refines its original communications regarding the size, pace, and composition of its ongoing asset purchase program by noting that these aspects depend on the extent of progress toward its economic objectives (March) and the inflation outlook (May).

- May 22, 2013; June 19, 2013: During the Q&A for his testimony before the Joint Economic Committee to Congress on May 22, Chairman Bernanke says that the FOMC "could in the next few meetings, take a step down in [its] pace of purchases" if its members see continued improvement and expect that improvement to be sustained. During the June 19 postmeeting press conference, the Chairman remarks that the FOMC "currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year." Longer-term yields and the dollar rise substantially following the remarks, a reaction that has come to be called the "taper tantrum."

- December 18, 2013: The FOMC announces it will start to taper its purchases of MBS and longer-term Treasuries to a pace of $35 billion and $40 billion per month, respectively, and will "likely reduce the pace of asset purchases in further measured steps at future meetings." Further reductions of $10 billion in total asset purchases ($5 billion each for MBS and Treasury securities) are announced at each subsequent FOMC meeting through September 2014.

- September 17, 2014: The FOMC publishes a separate postmeeting statement called "Policy Normalization Principles and Plans." In that statement, the Committee announces its intention to hold "no more securities than necessary to implement monetary policy efficiently and effectively" and to hold "primarily Treasury securities" in the longer run.

- October 29, 2014: The FOMC announces that it will "conclude its asset purchase program this month." The policy of reinvesting the principal of maturing securities is maintained.

- December 16, 2015: On the date that the FOMC raises the target range from its effective lower bound, the FOMC states that it anticipates maintaining its reinvestment policy "until normalization of the level of the federal funds rate is well under way."

- April 5, 2017: The minutes for the March 2017 FOMC meeting state that "most participants […] judged that a change to the Committee's reinvestment policy would likely be appropriate later this year," that "participants generally preferred to phase out or cease reinvestments of both Treasury securities and agency MBS," and that "reductions in the Federal Reserve's securities holdings should be gradual and predictable, and accomplished primarily by phasing out reinvestments."

- June 14, 2017: The FOMC states that it "expects to begin implementing a balance sheet normalization program this year." The balance sheet normalization process is outlined in an "Addendum to the Policy Normalization Principles and Plans" released along with the postmeeting statement.

- July 26, 2017: The FOMC states that it expects to begin implementing its balance sheet normalization program "relatively soon, provided that the economy evolves broadly as anticipated."

- September 20, 2017: The FOMC announces that, "in October, the Committee will initiate the balance sheet normalization program described in the June 2017 Addendum to the Committee's Policy Normalization Principles and Plans."

Sources: FRED, Federal Reserve Bank of St. Louis.

Notes: Headline and core PCE inflation are shown on a 12−month basis. Real GDP growth is shown on a four−quarter change basis. The unemployment rate is on a monthly basis.