-

Banks and Banking

- Regulation F: Limitations on Interbank Liabilities

-

Regulation H: Membership of State Banking Institutions in the Federal Reserve System

-

SUBPART A—GENERAL MEMBERSHIP AND BRANCHING REQUIREMENTS

- SECTION 208.1—Authority, Purpose, and Scope

- SECTION 208.2—Definitions

- SECTION 208.3—Application and Conditions for Membership in the Federal Reserve System

- SECTION 208.4—Capital Adequacy

- SECTION 208.5—Dividends and Other Distributions

- SECTION 208.6—Establishment and Maintenance of Branches

- SECTION 208.7—Prohibition Against Use of Interstate Branches Primarily for Deposit Production

-

SUBPART B—INVESTMENTS AND LOANS

- SECTION 208.20—Authority, Purpose, and Scope

- SECTION 208.21—Investments in Premises and Securities

- SECTION 208.22—Community Development and Public-Welfare Investments

- SECTION 208.23—Agricultural Loan Loss Amortization

- SECTION 208.24—Letters of Credit and Acceptances

- SECTION 208.25—Loans in Areas Having Special Flood Hazards

- Appendix A to Section 208.25—Sample Form of Notice of Special Flood Hazards and Availability of Federal Disaster Relief Assistance

- Appendix B to Section 208.25—Sample Clause for Option to Escrow for Outstanding Loans

-

SUBPART C—BANK SECURITIES AND SECURITIES-RELATED ACTIVITIES

- SECTION 208.30—Authority, Purpose, and Scope

- SECTION 208.31—State Member Banks as Transfer Agents

- SECTION 208.32—Notice of Disciplinary Sanctions Imposed by Registered Clearing Agency

- SECTION 208.33—Application for Stay or Review of Disciplinary Sanctions Imposed by Registered Clearing Agency

- SECTION 208.34—Recordkeeping and Confirmation of Certain Securities Transactions Effected by State Member Banks

- SECTION 208.35—Qualification Requirements for Transactions in Certain Securities

- SECTION 208.36—Reporting Requirements for State Member Banks Subject to the Securities Exchange Act of 1934

- SECTION 208.37—Government Securities Sales Practices

-

SUBPART D—PROMPT CORRECTIVE ACTION

- SECTION 208.40—Authority, Purpose, Scope, Other Supervisory Authority, and Disclosure of Capital Categories

- SECTION 208.41—Definitions for Purposes of This Subpart

- SECTION 208.42—Notice of Capital Category

- SECTION 208.43—Capital Measures and Capital-Category Definitions

- SECTION 208.44—Capital-Restoration Plans

- SECTION 208.45—Mandatory and Discretionary Supervisory Actions under Section 38

- SUBPART E—REAL ESTATE LENDING, APPRAISAL STANDARDS, AND MINIMUM REQUIREMENTS FOR APPRAISAL MANAGEMENT COMPANIES

- SUBPART F—MISCELLANEOUS REQUIREMENTS

-

SUBPART G—FINANCIAL SUBSIDIARIES OF STATE MEMBER BANKS

- SECTION 208.71—What are the requirements to invest in or control a financial subsidiary?

- SECTION 208.72—What activities may a financial subsidiary conduct?

- SECTION 208.73—What additional provisions are applicable to state member banks with financial subsidiaries?

- SECTION 208.74—What happens if the state member bank or a depository institution affiliate fails to continue to meet certain requirements?

- SECTION 208.75—What happens if the state member bank or any of its insured depository institution affiliates receives less than a satisfactory CRA rating?

- SECTION 208.76—What Federal Reserve approvals are necessary for financial subsidiaries?

- SECTION 208.77—Definitions

- SUBPART H—CONSUMER PROTECTION IN SALES OF INSURANCE

- SUBPART I—[REMOVED AND RESERVED]

- SUBPART J—INTERPRETATIONS

- SUBPART K—FORMS, INSTRUCTIONS, AND REPORTS

- APPENDIX A—[Reserved]

- APPENDIX B—[Reserved]

- APPENDIX C—Interagency Guidelines for Real Estate Lending Policies

- APPENDIX D-1—Interagency Guidelines Establishing Standards for Safety and Soundness

- APPENDIX D-2—Interagency Guidelines Establishing Information Security Standards

- APPENDIX E—[Reserved]

- APPENDIX F—[Reserved]

-

SUBPART A—GENERAL MEMBERSHIP AND BRANCHING REQUIREMENTS

-

Regulation I: Federal Reserve Bank Capital Stock

- SECTION 209.1—Authority, Purpose, Scope, and Definitions

- SECTION 209.2—Banks Desiring to Become Member Banks

- SECTION 209.3—Cancellation of Reserve Bank Stock; Mergers Involving Member Banks

- SECTION 209.4—Amounts and Payments for Subscriptions and Cancellations; Timing and Rate of Dividends

- SECTION 209.5—The Share Register

-

Regulation K: International Banking Operations

-

SUBPART A—INTERNATIONAL OPERATIONS OF U.S. BANKING ORGANIZATIONS

- SECTION 211.1—Authority, Purpose, and Scope

- SECTION 211.2—Definitions

- SECTION 211.3—Foreign Branches of U.S. Banking Organizations

- SECTION 211.4—Permissible Activities and Investments of Foreign Branches of Member Banks

- SECTION 211.5—Edge and Agreement Corporations

- SECTION 211.6—Permissible Activities of Edge and Agreement Corporations in the United States

- SECTION 211.7—Voluntary Liquidation of Edge and Agreement Corporations

- SECTION 211.8—Investments and Activities Abroad

- SECTION 211.9—Investment Procedures

- SECTION 211.10—Permissible Activities Abroad

- SECTION 211.11—Advisory Opinions Under Regulation K

- SECTION 211.12—Lending Limits and Capital Requirements

- SECTION 211.13—Supervision and Reporting

-

SUBPART B—FOREIGN BANKING ORGANIZATIONS

- SECTION 211.20—Authority, Purpose, and Scope

- SECTION 211.21—Definitions

- SECTION 211.22—Interstate Banking Operations of Foreign Banking Organizations

- SECTION 211.23—Nonbanking Activities of Foreign Banking Organizations

- SECTION 211.24—Approval of Offices of Foreign Banks; Procedures for Applications; Standards for Approval; Representative-Office Activities and Standards for Approval; Preservation of Existing Authority

- SECTION 211.25—Termination of Offices of Foreign Banks

- SECTION 211.26—Examination of Offices and Affiliates of Foreign Banks

- SECTION 211.27—Disclosure of Supervisory Information to Foreign Supervisors

- SECTION 211.28—Provisions Applicable to Branches and Agencies: Limitation on Loans to One Borrower

- SECTION 211.29—Applications by State Branches and State Agencies to Conduct Activities Not Permissible for Federal Branches

- SECTION 211.30—Criteria for Evaluating the U.S. Operations of Foreign Banks Not Subject to Consolidated Supervision

- SUBPART C—EXPORT TRADING COMPANIES

- SUBPART D—INTERNATIONAL LENDING SUPERVISION

-

SUBPART A—INTERNATIONAL OPERATIONS OF U.S. BANKING ORGANIZATIONS

-

Regulation L: Management Official Interlocks

- SECTION 212.1—Authority, Purpose, and Scope

- SECTION 212.2—Definitions

- SECTION 212.3—Prohibitions

- SECTION 212.4—Interlocking Relationships Permitted by Statute

- SECTION 212.5—Small-Market-Share Exemption

- SECTION 212.6—General Exemption

- SECTION 212.7—Change in Circumstances

- SECTION 212.8—Enforcement

- SECTION 212.9—Effect of Interlocks Act on Clayton Act

-

Regulation O: Loans to Executive Officers, Directors, and Principal Shareholders of Member Banks

- SECTION 215.1—Authority, Purpose, and Scope

- SECTION 215.2—Definitions

- SECTION 215.3—Extension of Credit

- SECTION 215.4—General Prohibitions

- SECTION 215.5—Additional Restrictions on Loans to Executive Officers of Member Banks

- SECTION 215.6—Prohibition on Knowingly Receiving Unauthorized Extension of Credit

- SECTION 215.7—Extensions of Credit Outstanding on March 10, 1979

- SECTION 215.8—Records of Member Banks

- SECTION 215.9—Disclosure of Credit from Member Banks to Executive Officers and Principal Shareholders

- SECTION 215.10—Reporting Requirement for Credit Secured by Certain Bank Stock

- SECTION 215.11—Civil Penalties

- SECTION 215.12—Application to Savings Associations

- Appendix—Section 5200 of the Revised Statutes

-

Regulation Q: Capital Adequacy of Bank Holding Companies, Savings and Loan Holding Companies, and State Member Banks

- SUBPART A—GENERAL PROVISIONS

- SUBPART B—CAPITAL RATIO REQUIREMENTS AND BUFFERS

- SUBPART C—DEFINITION OF CAPITAL

-

SUBPART D—RISK-WEIGHTED ASSETS—STANDARDIZED APPROACH

- SECTION 217.30—Applicability

- SECTION 217.31—Mechanics for Calculating Risk-Weighted Assets for General Credit Risk

- SECTION 217.32—General Risk Weights

- SECTION 217.33—Off-Balance Sheet Exposures

- SECTION 217.34—Derivative Contracts

- SECTION 217.35—Cleared Transactions

- SECTION 217.36—Guarantees and Credit Derivatives: Substitution Treatment

- SECTION 217.37—Collateralized Transactions

- SECTION 217.38—Unsettled Transactions

- SECTIONS 217.39–217.40—[Reserved]

- SECTION 217.41—Operational Requirements for Securitization Exposures

- SECTION 217.42—Risk-Weighted Assets for Securitization Exposures

- SECTION 217.43—Simplified Supervisory Formula Approach (SSFA) and the Gross-Up Approach

- SECTION 217.44—Securitization Exposures to Which the SSFA and Gross-Up Approach Do Not Apply

- SECTION 217.45—Recognition of Credit Risk Mitigants for Securitization Exposures

- SECTIONS 217.46–217.50—[Reserved]

- SECTION 217.51—Introduction and Exposure Measurement

- SECTION 217.52—Simple Risk-Weight Approach (SRWA)

- SECTION 217.53—Equity Exposures to Investment Funds

- SECTIONS 217.54–217.60—[Reserved]

- SECTION 217.61—Purpose and Scope

- SECTION 217.62—Disclosure Requirements

- SECTION 217.63—Disclosures by Board-Regulated Institutions Described in Section 217.61

- SECTIONS 217.64–217.99—[Reserved]

-

SUBPART E—RISK-WEIGHTED ASSETS—INTERNAL RATINGS-BASED AND ADVANCED MEASUREMENT APPROACHES

- SECTION 217.100—Purpose, Applicability, and Principle of Conservatism

- SECTION 217.101—Definitions

- SECTIONS 217.102–217.120—[Reserved]

- SECTION 217.121—Qualification Process

- SECTION 217.122—Qualification Requirements

- SECTION 217.123—Ongoing Qualification

- SECTION 217.124—Merger and Acquisition Transitional Arrangements

- SECTIONS 217.125–217.130—[Reserved]

- SECTION 217.131—Mechanics for Calculating Total Wholesale and Retail Risk-Weighted Assets

- SECTION 217.132—Counterparty Credit Risk of Repo-Style Transactions, Eligible Margin Loans, and OTC Derivative Contracts

- SECTION 217.133—Cleared Transactions

- SECTION 217.134—Guarantees and Credit Derivatives: PD Substitution and LGD Adjustment Approaches

- SECTION 217.135—Guarantees and Credit Derivatives: Double Default Treatment

- SECTION 217.136—Unsettled Transactions

- SECTIONS 217.137–217.140—[Reserved]

- SECTION 217.141—Operational Criteria for Recognizing the Transfer of Risk

- SECTION 217.142—Risk-Weighted Assets for Securitization Exposures

- SECTION 217.143—Supervisory Formula Approach (SFA)

- SECTION 217.144—Simplified Supervisory Formula Approach (SSFA)

- SECTION 217.145—Recognition of Credit Risk Mitigants for Securitization Exposures

- SECTIONS 217.146–217.150—[Reserved]

- SECTION 217.151—Introduction and Exposure Measurement

- SECTION 217.152—Simple Risk Weight Approach (SRWA)

- SECTION 217.153—Internal Models Approach (IMA)

- SECTION 217.154—Equity Exposures to Investment Funds

- SECTION 217.155—Equity Derivative Contracts

- SECTIONS 217.156–217.160—[Reserved]

- SECTION 217.161—Qualification Requirements for Incorporation of Operational Risk Mitigants

- SECTION 217.162—Mechanics of Risk-Weighted Asset Calculation

- SECTIONS 217.163–217.170—[Reserved]

- SECTION 217.171—Purpose and Scope

- SECTION 217.172—Disclosure Requirements

- SECTION 217.173—Disclosures by Certain Advanced Approaches Board-Regulated Institutions and Category III Board-Regulated Institutions

- SECTIONS 217.174–217.200—[Reserved]

-

SUBPART F—RISK-WEIGHTED ASSETS—MARKET RISK

- SECTION 217.201—Purpose, Applicability, and Reservation of Authority

- SECTION 217.202—Definitions

- SECTION 217.203—Requirements for Application of this Subpart F

- SECTION 217.204—Measure for Market Risk

- SECTION 217.205—VaR-Based Measure

- SECTION 217.206—Stressed VaR-Based Measure

- SECTION 217.207—Specific Risk

- SECTION 217.208—Incremental Risk

- SECTION 217.209—Comprehensive Risk

- SECTION 217.210—Standardized Measurement Method for Specific Risk

- SECTION 217.211—Simplified Supervisory Formula Approach (SSFA)

- SECTION 217.212—Market Risk Disclosures

- SECTIONS 217.213–217.299—[Reserved]

-

SUBPART G—TRANSITION PROVISIONS

- SECTION 217.300—Transitions

- SECTION 217.301—Current Expected Credit Losses (CECL) Transition

- SECTION 217.302—Exposures Related to the Money Market Mutual Fund Liquidity Facility

- SECTION 217.303—Temporary Exclusions from Total Leverage Exposure

- SECTION 217.304—Temporary Changes to the Community Bank Leverage Ratio Framework

- SECTION 217.305—Exposures Related to the Paycheck Protection Program Lending Facility

- SECTION 217.306—Building Block Approach (BBA) Capital Conservation Buffer Transition

-

SUBPART H—RISK-BASED CAPITAL SURCHARGE FOR GLOBAL SYSTEMICALLY IMPORTANT BANK HOLDING COMPANIES

- SECTION 217.400—Purpose and Applicability

- SECTION 217.401—Definitions

- SECTION 217.402—Identification as a Global Systemically Important BHC

- SECTION 217.403—GSIB Surcharge

- SECTION 217.404—Method 1 Score

- SECTION 217.405—Method 2 Score

- SECTION 217.406—Short-Term Wholesale Funding Score

- Appendix to Subpart H—Calibrating the GSIB Surcharge

-

SUBPART I—APPLICATION OF CAPITAL RULES

- SECTION 217.501—The Board’s Regulatory Capital Framework for Depository Institution Holding Companies Organized as Non-Stock Companies

- SECTION 217.502—Application of the Board’s Regulatory Capital Framework to Employee Stock Ownership Plans that are Depository Institution Holding Companies and Certain Trusts that are Savings and Loan Holding Companies

-

SUBPART J—RISK-BASED CAPITAL REQUIREMENTS FOR BOARD-REGULATED INSTITUTIONS SIGNIFICANTLY ENGAGED IN INSURANCE ACTIVITIES

- SECTION 217.601—Purpose, Applicability, and Reservations of Authority

- SECTION 217.602—Definitions

- SECTION 217.603—BBA Ratio and Minimum Requirements

- SECTION 217.604—Capital Conservation Buffer

- SECTION 217.605—Determination of Building Blocks

- SECTION 217.606—Scaling Parameters

- SECTION 217.607—Capital Requirements under the Building Block Approach

- SECTION 217.608—Available Capital Resources under the Building Block Approach

- APPENDIX A—The Federal Reserve Board's Framework for Implementing the Countercyclical Capital Buffer

-

Regulation R: Exceptions for Banks from the Definition of Broker in the Securities Exchange Act of 1934

- SECTION 218.100—Definition

- SECTION 218.700—Defined Terms Relating to the Networking Exception from the Definition of Broker

- SECTION 218.701—Exemption from the Definition of Broker for Certain Institutional Referrals

- SECTION 218.721—Defined Terms Relating to the Trust and Fiduciary Activities Exception from the Definition of Broker

- SECTION 218.722—Exemption Allowing Banks to Calculate Trust and Fiduciary Compensation on a Bankwide Basis

- SECTION 218.723—Exemptions for Special Accounts, Transferred Accounts, Foreign Branches and a de Minimis Number of Accounts

- SECTION 218.740—Defined Terms Relating to the Sweep Accounts Exception from the Definition of Broker

- SECTION 218.741—Exemption for Banks Effecting Transactions in Money Market Funds

- SECTION 218.760—Exemption from Definition of Broker for Banks Accepting Orders to Effect Transactions in Securities from or on Behalf of Custody Accounts

- SECTION 218.771—Exemption from the Definition of Broker for Banks Effecting Transactions in Securities Issued Pursuant to Regulation S

- SECTION 218.772—Exemption from the Definition of Broker for Banks Engaging in Securities-Lending Transactions

- SECTION 218.775—Exemption from the Definition of Broker for Banks Effecting Certain Excepted or Exempted Transactions in Investment Company Securities

- SECTION 218.776—Exemption from the Definition of Broker for Banks Effecting Certain Excepted or Exempted Transactions in a Company’s Securities for its Employee Benefit Plans

- SECTION 218.780—Exemption for Banks from Liability Under Section 29 of the Securities Exchange Act of 1934

- SECTION 218.781—Exemption from the Definition of Broker for Banks for a Limited Period of Time

-

Regulation S: Reimbursement for Providing Financial Records; Recordkeeping Requirements for Certain Financial Records

- SUBPART A—REIMBURSEMENT TO FINANCIAL INSTITUTIONS FOR PROVIDING FINANCIAL RECORDS

- SUBPART B—RECORDKEEPING AND REPORTING REQUIREMENTS FOR FUNDS TRANSFERS AND TRANSMITTALS OF FUNDS

-

Regulation W: Transactions Between Member Banks and Their Affiliates

- SUBPART A—INTRODUCTION AND DEFINITIONS

-

SUBPART B—GENERAL PROVISIONS OF SECTION 23A

- SECTION 223.11—What is the maximum amount of covered transactions that a member bank may enter into with any single affiliate?

- SECTION 223.12—What is the maximum amount of covered transactions that a member bank may enter into with all affiliates?

- SECTION 223.13—What safety-and-soundness requirement applies to covered transactions?

- SECTION 223.14—What are the collateral requirements for a credit transaction with an affiliate?

- SECTION 223.15—May a member bank purchase a low-quality asset from an affiliate?

- SECTION 223.16—What transactions by a member bank with any person are treated as transactions with an affiliate?

-

SUBPART C—VALUATION AND TIMING PRINCIPLES UNDER SECTION 23A

- SECTION 223.21—What valuation and timing principles apply to credit transactions?

- SECTION 223.22—What valuation and timing principles apply to asset purchases?

- SECTION 223.23—What valuation and timing principles apply to purchases of and investments in securities issued by an affiliate?

- SECTION 223.24—What valuation principles apply to extensions of credit secured by affiliate securities?

-

SUBPART D—OTHER REQUIREMENTS UNDER SECTION 23A

- SECTION 223.31—How does section 23A apply to a member bank’s acquisition of an affiliate that becomes an operating subsidiary of the member bank after the acquisition?

- SECTION 223.32—What rules apply to financial subsidiaries of a member bank?

- SECTION 223.33—What rules apply to derivative transactions?

-

SUBPART E—EXEMPTIONS FROM THE PROVISIONS OF SECTION 23A

- SECTION 223.41—What covered transactions are exempt from the quantitative limits and collateral requirements?

- SECTION 223.42—What covered transactions are exempt from the quantitative limits, collateral requirements, and low-quality-asset prohibition?

- SECTION 223.43—What are the standards under which the Board may grant additional exemptions from the requirements of section 23A?

-

SUBPART F—GENERAL PROVISIONS OF SECTION 23B

- SECTION 223.51—What is the market-terms requirement of section 23B?

- SECTION 223.52—What transactions with affiliates or others must comply with section 23B’s market-terms requirement?

- SECTION 223.53—What asset purchases are prohibited by section 23B?

- SECTION 223.54—What advertisements and statements are prohibited by section 23B?

- SECTION 223.55—What are the standards under which the Board may grant exemptions from the requirements of section 23B?

- SECTION 223.56—What transactions are exempt from the market-terms requirement of section 23B?

- SUBPART G—APPLICATION OF SECTIONS 23A AND 23B TO U.S. BRANCHES AND AGENCIES OF FOREIGN BANKS

- SUBPART H—MISCELLANEOUS INTERPRETATIONS

- SUBPART I—SAVINGS ASSOCIATIONS—TRANSACTIONS WITH AFFILIATES

-

Regulation KK: Swaps Margin and Swaps Push-Out

-

SUBPART A—MARGIN AND CAPITAL REQUIREMENTS FOR COVERED SWAP ENTITIES

- SECTION 237.1—Authority, Purpose, Scope, Exemptions, and Compliance Dates

- SECTION 237.2—Definitions

- SECTION 237.3—Initial Margin

- SECTION 237.4—Variation Margin

- SECTION 237.5—Netting Arrangements, Minimum Transfer Amount, and Satisfaction of Collecting and Posting Requirements

- SECTION 237.6—Eligible Collateral

- SECTION 237.7—Segregation of Collateral

- SECTION 237.8—Initial Margin Models and Standardized Amounts

- SECTION 237.9—Cross-Border Application of Margin Requirements

- SECTION 237.10—Documentation of Margin Matters

- SECTION 237.11—Special Rules for Affiliates

- SECTION 237.12—Capital

- APPENDIX A TO SUBPART A—Standardized Minimum Initial Margin Requirements for Non-Cleared Swaps and Non-Cleared Security-Based Swaps

- APPENDIX B TO SUBPART A—Margin Values for Eligible Noncash Margin Collateral

- SUBPART B—PROHIBITION AGAINST FEDERAL ASSISTANCE TO SWAPS ENTITIES

-

SUBPART A—MARGIN AND CAPITAL REQUIREMENTS FOR COVERED SWAP ENTITIES

-

Regulation NN: Retail Foreign Exchange Transactions

- SECTION 240.1—Authority, Purpose, and Scope

- SECTION 240.2—Definitions

- SECTION 240.3—Prohibited Transactions

- SECTION 240.4—Notification

- SECTION 240.5—Application and Closing Out of Offsetting Long and Short Positions

- SECTION 240.6—Disclosure

- SECTION 240.7—Recordkeeping

- SECTION 240.8—Capital Requirements

- SECTION 240.9—Margin Requirements

- SECTION 240.10—Required Reporting to Customers

- SECTION 240.11—Unlawful Representations

- SECTION 240.12—Authorization to Trade

- SECTION 240.13—Trading and Operational Standards

- SECTION 240.14—Supervision

- SECTION 240.15—Notice of Transfers

- SECTION 240.16—Customer Dispute Resolution

- SECTION 240.17—Reservation of Authority

-

Regulation VV: Proprietary Trading and Certain Interests in and Relationships with Covered Funds

- SUBPART A—AUTHORITY AND DEFINITIONS

-

SUBPART B—PROPRIETARY TRADING

- SECTION 248.3—Prohibition on Proprietary Trading

- SECTION 248.4—Permitted Underwriting and Market Making-Related Activities

- SECTION 248.5—Permitted Risk-Mitigating Hedging Activities

- SECTION 248.6—Other Permitted Proprietary Trading Activities

- SECTION 248.7—Limitations on Permitted Proprietary Trading Activities

- SECTION 248.8—[Reserved]

- SECTION 248.9—[Reserved]

-

SUBPART C—COVERED FUND ACTIVITIES AND INVESTMENTS

- SECTION 248.10—Prohibition on Acquiring or Retaining an Ownership Interest in and Having Certain Relationships with a Covered Fund

- SECTION 248.11—Permitted Organizing and Offering, Underwriting, and Market Making with Respect to a Covered Fund

- SECTION 248.12—Permitted Investment in a Covered Fund

- SECTION 248.13—Other Permitted Covered Fund Activities and Investments

- SECTION 248.14—Limitations on Relationships with a Covered Fund

- SECTION 248.15—Other Limitations on Permitted Covered Fund Activities and Investments

- SECTION 248.16—Ownership of Interests in and Sponsorship of Issuers of Certain Collateralized Debt Obligations Backed by Trust-Preferred Securities

- SECTION 248.17—[Reserved]

- SECTION 248.18—[Reserved]

- SECTION 248.19—[Reserved]

- SUBPART D—COMPLIANCE PROGRAM REQUIREMENT; VIOLATIONS

- APPENDIX A—Reporting and Recordkeeping Requirements for Covered Trading Activities

-

Regulation WW: Liquidity Risk Measurement, Standards, and Monitoring

- SUBPART A—GENERAL PROVISIONS

- SUBPART B—LIQUIDITY COVERAGE RATIO

- SUBPART C—HIGH-QUALITY LIQUID ASSETS

- SUBPART D—TOTAL NET CASH OUTFLOW

- SUBPART E—LIQUIDITY COVERAGE SHORTFALL

- SUBPART F—TRANSITIONS

- SUBPARTS G–I [RESERVED]

- SUBPART J—DISCLOSURES

-

SUBPART K—NET STABLE FUNDING RATIO

- SECTION 249.100—Net Stable Funding Ratio

- SECTION 249.101—Determining Maturity

- SECTION 249.102—Rules of Construction

- SECTION 249.103—Calculation of Available Stable Funding Amount

- SECTION 249.104—ASF Factors

- SECTION 249.105—Calculation of Required Stable Funding Amount

- SECTION 249.106—RSF Factors

- SECTION 249.107—Calculation of NSFR Derivatives Amounts

- SECTION 249.108—Funding Related to Covered Federal Reserve Facility Funding

- SECTION 249.109—Rules for Consolidation

- SUBPART L—NET STABLE FUNDING SHORTFALL

- SUBPART M—TRANSITIONS

- SUBPART N—NSFR PUBLIC DISCLOSURE

-

Regulation ZZ: Regulations Implementing the Adjustable Interest Rate (LIBOR) Act

- SECTION 253.1—Authority, Purpose, and Scope

- SECTION 253.2—Definitions

- SECTION 253.3—Applicability

- SECTION 253.4—Board-Selected Benchmark Replacements

- SECTION 253.5—Benchmark Replacement Conforming Changes

- SECTION 253.6—Preemption

- SECTION 253.7—Continuity of Contract and Safe Harbor

- APPENDIX A—ISDA Protocol

-

Department of the Treasury,

Financial Crimes Enforcement Network

- PARTS 1000–1009 [RESERVED]

-

PART 1010—GENERAL PROVISIONS

- SUBPART A—GENERAL DEFINITIONS

-

SUBPART B—PROGRAMS

- SECTION 1010.200—General

- SECTION 1010.205—Exempted Anti-Money Laundering Programs for Certain Financial Institutions

- SECTION 1010.210—Anti-Money Laundering Programs

- SECTION 1010.220—Customer Identification Program Requirements

- SECTION 1010.230—Beneficial Ownership Requirements for Legal Entity Customers

- Appendix A to Section 1010.230—Certification Regarding Beneficial Owners of Legal Entity Customers

-

SUBPART C—REPORTS REQUIRED TO BE MADE

- SECTION 1010.300—General

- SECTION 1010.301—Determination by the Secretary

- SECTION 1010.305—[Reserved]

- SECTION 1010.306—Filing of Reports

- SECTION 1010.310—Reports of Transactions in Currency

- SECTION 1010.311—Filing Obligations for Reports of Transactions in Currency

- SECTION 1010.312—Identification Required

- SECTION 1010.313—Aggregation

- SECTION 1010.314—Structured Transactions

- SECTION 1010.315—Exemptions for Non-Bank Financial Institutions

- SECTION 1010.320—Reports of Suspicious Transactions

- SECTION 1010.330—Reports Relating to Currency in Excess of $10,000 Received in a Trade or Business

- SECTION 1010.331—Reports Relating to Currency in Excess of $10,000 Received as Bail by Court Clerks

- SECTION 1010.340—Reports of Transportation of Currency or Monetary Instruments

- SECTION 1010.350—Reports of Foreign Financial Accounts

- SECTION 1010.360—Reports of Transactions with Foreign Financial Agencies

- SECTION 1010.370—Reports of Certain Domestic Transactions

- SECTION 1010.380—Reports of Beneficial Ownership Information

-

SUBPART D—RECORDS REQUIRED TO BE MAINTAINED

- SECTION 1010.400—General

- SECTION 1010.401—Determination by the Secretary

- SECTION 1010.405—[Reserved]

- SECTION 1010.410—Records to Be Made and Retained by Financial Institutions

- SECTION 1010.415—Purchases of Bank Checks and Drafts, Cashier’s Checks, Money Orders and Traveler’s Checks

- SECTION 1010.420—Records to Be Made and Retained by Persons Having Financial Interests in Foreign Financial Accounts

- SECTION 1010.430—Nature of Records and Retention Period

- SECTION 1010.440—Person Outside the United States

- SUBPART E—SPECIAL INFORMATION SHARING PROCEDURES TO DETER MONEY LAUNDERING AND TERRORIST ACTIVITY

-

SUBPART F—SPECIAL STANDARDS OF DILIGENCE; PROHIBITIONS; AND SPECIAL MEASURES

- SECTION 1010.600—General

- SECTION 1010.605—Definitions

- SECTION 1010.610—Due Diligence Programs for Correspondent Accounts for Foreign Financial Institutions

- SECTION 1010.620—Due Diligence Programs for Private Banking Accounts

- SECTION 1010.630—Prohibition on Correspondent Accounts for Foreign Shell Banks; Records Concerning Owners of Foreign Banks and Agents for Service of Legal Process

- SECTION 1010.640—[Reserved]

- SECTION 1010.651—Special Measures Against Burma

- SECTION 1010.653—Special Measures Against Commercial Bank of Syria

- SECTION 1010.658—Special Measures Against FBME Bank, Ltd.

- SECTION 1010.659—Special Measures Against North Korea

- SECTION 1010.660—Special Measures Against Bank of Dandong

- SECTION 1010.661—Special Measures Against Iran

- SECTION 1010.663—Special Measures Regarding Al-Huda Bank

- SECTION 1010.664—Special Measures Regarding Huione Group

- SECTION 1010.670—Summons or Subpoena of Foreign Bank Records; Termination of Correspondent Relationship

- SUBPART G—ADMINISTRATIVE RULINGS

-

SUBPART H—ENFORCEMENT; PENALTIES; AND FORFEITURE

- SECTION 1010.810—Enforcement

- SECTION 1010.820—Civil Penalty

- SECTION 1010.821—Penalty Adjustment and Table

- SECTION 1010.830—Forfeiture of Currency or Monetary Instruments

- SECTION 1010.840—Criminal Penalty

- SECTION 1010.850—Enforcement Authority with Respect to Transportation of Currency or Monetary Instruments

- SUBPART I—SUMMONS

-

SUBPART J—MISCELLANEOUS

- SECTION 1010.920—Access to Records

- SECTION 1010.930—Rewards for Informants

- SECTION 1010.940—Photographic or Other Reproductions of Government Obligations

- SECTION 1010.950—Availability of Information—General

- SECTION 1010.955—Availability of Beneficial Ownership Information Reported under This Part

- SECTION 1010.960—Disclosure

- SECTION 1010.970—Exceptions, Exemptions, and Reports

- SECTION 1010.980—Dollars as Including Foreign Currency

- PARTS 1011–1019 [RESERVED]

-

PART 1020—RULES FOR BANKS

- SUBPART A—DEFINITIONS

- SUBPART B—PROGRAMS

-

SUBPART C—REPORTS REQUIRED TO BE MADE BY BANKS

- SECTION 1020.300—General

- SECTION 1020.310—Reports of Transactions in Currency

- SECTION 1020.311—Filing Obligations

- SECTION 1020.312—Identification Required

- SECTION 1020.313—Aggregation

- SECTION 1020.314—Structured Transactions

- SECTION 1020.315—Transactions of Exempt Persons

- SECTION 1020.320—Reports by Banks of Suspicious Transactions

- SUBPART D—RECORDS REQUIRED TO BE MAINTAINED BY BANKS

- SUBPART E—SPECIAL INFORMATION SHARING PROCEDURES TO DETER MONEY LAUNDERING AND TERRORIST ACTIVITY

-

SUBPART F—SPECIAL STANDARDS OF DILIGENCE; PROHIBITIONS; AND SPECIAL MEASURES

- SECTION 1020.600—General

- SECTION 1020.610—Due Diligence Programs for Correspondent Accounts for Foreign Financial Institutions

- SECTION 1020.620—Due Diligence Programs for Private Banking Accounts

- SECTION 1020.630—Prohibition on Correspondent Accounts for Foreign Shell Banks; Records Concerning Owners of Foreign Banks and Agents for Service of Legal Process

- SECTION 1020.640—[Reserved]

- SECTION 1020.670—Summons or Subpoena of Foreign Bank Records; Termination of Correspondent Relationship

-

PART 1021—RULES FOR CASINOS AND CARD CLUBS

- SUBPART A—DEFINITIONS

- SUBPART B—PROGRAMS

-

SUBPART C—REPORTS REQUIRED TO BE MADE BY CASINOS AND CARD CLUBS

- SECTION 1021.300—General

- SECTION 1021.310—Reports of Transactions in Currency

- SECTION 1021.311—Filing Obligations

- SECTION 1021.312—Identification Required

- SECTION 1021.313—Aggregation

- SECTION 1021.314—Structured Transactions

- SECTION 1021.315—Exemptions

- SECTION 1021.320—Reports by Casinos of Suspicious Transactions

- SECTION 1021.330—Exceptions to the Reporting Requirements of 31 U.S.C. 5331

- SUBPART D—RECORDS REQUIRED TO BE MAINTAINED BY CASINOS AND CARD CLUBS

- SUBPART E—SPECIAL INFORMATION SHARING PROCEDURES TO DETER MONEY LAUNDERING AND TERRORIST ACTIVITY FOR CASINOS AND CARD CLUBS

-

SUBPART F—SPECIAL STANDARDS OF DILIGENCE; PROHIBITIONS; AND SPECIAL MEASURES FOR CASINOS AND CARD CLUBS

- SECTION 1021.600—General

- SECTION 1021.610—Due Diligence Programs for Correspondent Accounts for Foreign Financial Institutions

- SECTION 1021.620—Due Diligence Programs for Private Banking Accounts

- SECTION 1021.630—Prohibition on Correspondent Accounts for Foreign Shell Banks; Records Concerning Owners of Foreign Banks and Agents for Service of Legal Process

- SECTION 1021.640—[Reserved]

- SECTION 1021.670—Summons or Subpoena of Foreign Bank Records; Termination of Correspondent Relationship

-

PART 1022—RULES FOR MONEY SERVICES BUSINESSES

- SUBPART A—DEFINITIONS

- SUBPART B—PROGRAMS

-

SUBPART C—REPORTS REQUIRED TO BE MADE BY MONEY SERVICES BUSINESSES

- SECTION 1022.300—General

- SECTION 1022.310—Reports of Transactions in Currency

- SECTION 1022.311—Filing Obligations

- SECTION 1022.312—Identification Required

- SECTION 1022.313—Aggregation

- SECTION 1022.314—Structured Transactions

- SECTION 1022.315—Exemptions

- SECTION 1022.320—Reports by Money Services Businesses of Suspicious Transactions

- SECTION 1022.380—Registration of Money Services Businesses

- SUBPART D—RECORDS REQUIRED TO BE MAINTAINED BY MONEY SERVICES BUSINESSES

- SUBPART E—SPECIAL INFORMATION SHARING PROCEDURES TO DETER MONEY LAUNDERING AND TERRORIST ACTIVITY

- SUBPART F—SPECIAL STANDARDS OF DILIGENCE; PROHIBITIONS; AND SPECIAL MEASURES FOR MONEY SERVICES BUSINESSES

-

PART 1023—RULES FOR BROKERS OR DEALERS IN SECURITIES

- SUBPART A—DEFINITIONS

- SUBPART B—PROGRAMS

-

SUBPART C—REPORTS REQUIRED TO BE MADE BY BROKERS OR DEALERS IN SECURITIES

- SECTION 1023.300—General

- SECTION 1023.310—Reports of Transactions in Currency

- SECTION 1023.311—Filing Obligations

- SECTION 1023.312—Identification Required

- SECTION 1023.313—Aggregation

- SECTION 1023.314—Structured Transactions

- SECTION 1023.315—Exemptions

- SECTION 1023.320—Reports by Brokers or Dealers in Securities of Suspicious Transactions

- SUBPART D—RECORDS REQUIRED TO BE MAINTAINED BY BROKERS OR DEALERS IN SECURITIES

- SUBPART E—SPECIAL INFORMATION SHARING PROCEDURES TO DETER MONEY LAUNDERING AND TERRORIST ACTIVITY

-

SUBPART F—SPECIAL STANDARDS OF DILIGENCE; PROHIBITIONS; AND SPECIAL MEASURES FOR BROKERS OR DEALERS IN SECURITIES

- SECTION 1023.600—General

- SECTION 1023.610—Due Diligence Programs for Correspondent Accounts for Foreign Financial Institutions

- SECTION 1023.620—Due Diligence Programs for Private Banking Accounts

- SECTION 1023.630—Prohibition on Correspondent Accounts for Foreign Shell Banks; Records Concerning Owners of Foreign Banks and Agents for Service of Legal Process

- SECTION 1023.640—[Reserved]

- SECTION 1023.670—Summons or Subpoena of Foreign Bank Account Records; Termination of Correspondent Relationship

-

PART 1024—RULES FOR MUTUAL FUNDS

- SUBPART A—DEFINITIONS

- SUBPART B—PROGRAMS

-

SUBPART C—REPORTS REQUIRED TO BE MADE BY MUTUAL FUNDS

- SECTION 1024.300—General

- SECTION 1024.310—Reports of Transactions in Currency

- SECTION 1024.311—Filing Obligations

- SECTION 1024.312—Identification Required

- SECTION 1024.313—Aggregation

- SECTION 1024.314—Structured Transactions

- SECTION 1024.315—Exemptions

- SECTION 1024.320—Reports by Mutual Funds of Suspicious Transactions

- SUBPART D—RECORDS REQUIRED TO BE MAINTAINED BY MUTUAL FUNDS

- SUBPART E—SPECIAL INFORMATION SHARING PROCEDURES TO DETER MONEY LAUNDERING AND TERRORIST ACTIVITY

-

SUBPART F—SPECIAL STANDARDS OF DILIGENCE; PROHIBITIONS; AND SPECIAL MEASURES FOR MUTUAL FUNDS

- SECTION 1024.600—General

- SECTION 1024.610—Due Diligence Programs for Correspondent Accounts for Foreign Financial Institution

- SECTION 1024.620—Due Diligence Programs for Private Banking Accounts

- SECTION 1024.630—Prohibition on Correspondent Accounts for Foreign Shell Banks; Records Concerning Owners of Foreign Banks and Agents for Service of Legal Process

- SECTION 1024.640—[Reserved]

- SECTION 1024.670—[Reserved]

-

PART 1025—RULES FOR INSURANCE COMPANIES

- SUBPART A—DEFINITIONS

- SUBPART B—PROGRAMS

- SUBPART C—REPORTS REQUIRED TO BE MADE BY INSURANCE COMPANIES

- SUBPART D—RECORDS REQUIRED TO BE MAINTAINED BY INSURANCE COMPANIES

- SUBPART E—SPECIAL INFORMATION SHARING PROCEDURES TO DETER MONEY LAUNDERING AND TERRORIST ACTIVITY

- SUBPART F—SPECIAL STANDARDS OF DILIGENCE; PROHIBITIONS; AND SPECIAL MEASURES FOR INSURANCE COMPANIES

-

PART 1026—RULES FOR FUTURES COMMISSION MERCHANTS AND INTRODUCING BROKERS IN COMMODITIES

- SUBPART A—DEFINITIONS

- SUBPART B—PROGRAMS

-

SUBPART C—REPORTS REQUIRED TO BE MADE BY FUTURES COMMISSION MERCHANTS AND INTRODUCING BROKERS IN COMMODITIES

- SECTION 1026.300—General

- SECTION 1026.310—Reports of Transactions in Currency

- SECTION 1026.311—Filing Obligations

- SECTION 1026.312—Identification Required

- SECTION 1026.313—Aggregation

- SECTION 1026.314—Structured Transactions

- SECTION 1026.315—Exemptions

- SECTION 1026.320—Reports by Futures Commission Merchants and Introducing Brokers in Commodities of Suspicious Transactions

- SUBPART D—RECORDS REQUIRED TO BE MAINTAINED BY FUTURES COMMISSION MERCHANTS AND INTRODUCING BROKERS IN COMMODITIES

-

SUBPART E—SPECIAL INFORMATION SHARING PROCEDURES TO DETER MONEY LAUNDERING AND TERRORIST ACTIVITY

- SECTION 1026.500—General

- SECTION 1026.520—Special Information Sharing Procedures to Deter Money Laundering and Terrorist Activity for Futures Commission Merchants and Introducing Brokers in Commodities

- SECTION 1026.530—[Reserved]

- SECTION 1026.540—Voluntary Information Sharing Among Financial Institutions

-

SUBPART F—SPECIAL STANDARDS OF DILIGENCE; PROHIBITIONS; AND SPECIAL MEASURES FOR FUTURES COMMISSION MERCHANTS AND INTRODUCING BROKERS IN COMMODITIES

- SECTION 1026.600—General

- SECTION 1026.610—Due Diligence Programs for Correspondent Accounts for Foreign Financial Institutions

- SECTION 1026.620—Due Diligence Programs for Private Banking Accounts

- SECTION 1026.630—Prohibition on Correspondent Accounts for Foreign Shell Banks; Records Concerning Owners of Foreign Banks and Agents for Service of Legal Process

- SECTION 1026.640—[Reserved]

- SECTION 1026.670—Summons or Subpoena of Foreign Bank Records; Termination of Correspondent Relationship

-

PART 1027—RULES FOR DEALERS IN PRECIOUS METALS, PRECIOUS STONES, OR JEWELS

- SUBPART A—DEFINITIONS

- SUBPART B—PROGRAMS

- SUBPART C—REPORTS REQUIRED TO BE MADE BY DEALERS IN PRECIOUS METALS, PRECIOUS STONES, OR JEWELS

- SUBPART D—RECORDS REQUIRED TO BE MAINTAINED BY DEALERS IN PRECIOUS METALS, PRECIOUS STONES, OR JEWELS

- SUBPART E—SPECIAL INFORMATION SHARING PROCEDURES TO DETER MONEY LAUNDERING AND TERRORIST ACTIVITY

- SUBPART F—SPECIAL STANDARDS OF DILIGENCE; PROHIBITIONS; AND SPECIAL MEASURES FOR DEALERS IN PRECIOUS METALS, PRECIOUS STONES, OR JEWELS

-

PART 1028—RULES FOR OPERATORS OF CREDIT CARD SYSTEMS

- SUBPART A—DEFINITIONS

- SUBPART B—PROGRAMS

- SUBPART C—REPORTS REQUIRED TO BE MADE BY OPERATORS OF CREDIT CARD SYSTEMS

- SUBPART D—RECORDS REQUIRED TO BE MAINTAINED BY OPERATORS OF CREDIT CARD SYSTEMS

- SUBPART E—SPECIAL INFORMATION SHARING PROCEDURES TO DETER MONEY LAUNDERING AND TERRORIST ACTIVITY

- SUBPART F—SPECIAL STANDARDS OF DILIGENCE; PROHIBITIONS; AND SPECIAL MEASURES FOR OPERATORS OF CREDIT CARD SYSTEMS

-

PART 1029—RULES FOR LOAN OR FINANCE COMPANIES

- SUBPART A—DEFINITIONS

- SUBPART B—PROGRAMS

- SUBPART C—REPORTS REQUIRED TO BE MADE BY LOAN OR FINANCE COMPANIES

- SUBPART D—RECORDS REQUIRED TO BE MAINTAINED BY LOAN OR FINANCE COMPANIES

- SUBPART E—SPECIAL INFORMATION SHARING PROCEDURES TO DETER MONEY LAUNDERING AND TERRORIST ACTIVITY

- SUBPART F—SPECIAL STANDARDS OF DILIGENCE; PROHIBITIONS, AND SPECIAL MEASURES FOR LOAN OR FINANCE COMPANIES

-

PART 1030—RULES FOR HOUSING GOVERNMENT SPONSORED ENTERPRISES

- SUBPART A—DEFINITIONS

- SUBPART B—PROGRAMS

- SUBPART C—REPORTS REQUIRED TO BE MADE BY HOUSING GOVERNMENT SPONSORED ENTERPRISES

- SUBPART D—RECORDS REQUIRED TO BE MAINTAINED BY HOUSING GOVERNMENT SPONSORED ENTERPRISES

- SUBPART E—SPECIAL INFORMATION SHARING PROCEDURES TO DETER MONEY LAUNDERING AND TERRORIST ACTIVITY

- SUBPART F—SPECIAL STANDARDS OF DILIGENCE; PROHIBITIONS, AND SPECIAL MEASURES FOR HOUSING GOVERNMENT SPONSORED ENTERPRISESSECTIONS 1030.600–1030.670—[Reserved]

-

PART 1031—RULES FOR PERSONS INVOLVED IN REAL ESTATE CLOSINGS AND SETTLEMENTS

- SUBPARTS A AND B—[RESERVED]

- SUBPART C—REPORTS REQUIRED TO BE MADE BY PERSONS INVOLVED IN REAL ESTATE CLOSINGS AND SETTLEMENTS

- PARTS 1032–1059 [RESERVED]

-

PART 1060—PROVISIONS RELATING TO THE COMPREHENSIVE IRAN SANCTIONS, ACCOUNTABILITY, AND DIVESTMENT ACT OF 2010

- SECTION 1060.100—[Reserved]

- SECTION 1060.200—[Reserved]

- SECTION 1060.300—Reporting Obligations on Foreign Bank Relationships with Iranian-Linked Financial Institutions Designated Under IEEPA and IRGC-Linked Persons Designated Under IEEPA

- SECTION 1060.400—[Reserved]

- SECTION 1060.500—[Reserved]

- SECTION 1060.600—[Reserved]

- SECTION 1060.700—[Reserved]

- SECTION 1060.800—Penalties

- PARTS 1061–1099 [RESERVED]

3-2134

SECTION 217.34—Derivative Contracts

(a) Exposure amount for derivative contracts.

(1) Board-regulated institution that is not an advanced approaches Board-regulated institution.

(i) A Board-regulated institution that is not an advanced approaches Board-regulated institution must use the current exposure methodology (CEM) described in paragraph (b) of this section to calculate the exposure amount for all its OTC derivative contracts, unless the Board-regulated institution makes the election provided in paragraph (a)(1)(ii) of this section.

(ii) A Board-regulated institution that is not an advanced approaches Board-regulated institution may elect to calculate the exposure amount for all its OTC derivative contracts under the standardized approach for counterparty credit risk (SA-CCR) in section 217.132(c) by notifying the Board, rather than calculating the exposure amount for all its derivative contracts using CEM. A Board-regulated institution that elects under this paragraph (a)(1)(ii) to calculate the exposure amount for its OTC derivative contracts under SA-CCR must apply the treatment of cleared transactions under section 217.133 to its derivative contracts that are cleared transactions and to all default fund contributions associated with such derivative contracts, rather than applying section 217.35. A Board-regulated institution that is not an advanced approaches Board-regulated institution must use the same methodology to calculate the exposure amount for all its derivative contracts and, if a Board-regulated institution has elected to use SA-CCR under this paragraph (a)(1)(ii), the Board-regulated institution may change its election only with prior approval of the Board.

(2) Advanced approaches Board-regulated institution. An advanced approaches Board-regulated institution must calculate the exposure amount for all its derivative contracts using SA-CCR in section 217.132(c) for purposes of standardized total risk-weighted assets. An advanced approaches Board-regulated institution must apply the treatment of cleared transactions under section 217.133 to its derivative contracts that are cleared transactions and to all default fund contributions associated with such derivative contracts for purposes of standardized total risk-weighted assets.

(b) Current exposure methodology exposure amount.

(1) Single OTC derivative contract. Except as modified by paragraph (c) of this section, the exposure amount for a single OTC derivative contract that is not subject to a qualifying master netting agreement is equal to the sum of the Board-regulated institution’s current credit exposure and potential future credit exposure (PFE) on the OTC derivative contract.

(i) Current credit exposure. The current credit exposure for a single OTC derivative contract is the greater of the fair value of the OTC derivative contract or zero.

(ii) PFE.

(A) The PFE for a single OTC derivative contract, including an OTC derivative contract with a negative fair value, is calculated by multiplying the notional principal amount of the OTC derivative contract by the appropriate conversion factor in Table 1 to this section.

| Remaining maturity2 | Interest rate | Foreign exchange rate and gold | Credit (investment grade reference asset)3 | Credit (non-investment-grade reference asset) | Equity | Precious metals (except gold) | Other |

|---|---|---|---|---|---|---|---|

| One year or less | 0.00 | 0.01 | 0.05 | 0.10 | 0.06 | 0.07 | 0.10 |

| Greater than one year and less than or equal to five years | 0.005 | 0.05 | 0.05 | 0.10 | 0.08 | 0.07 | 0.12 |

| Greater than five years | 0.015 | 0.075 | 0.05 | 0.10 | 0.10 | 0.08 | 0.15 |

1 For a derivative contract with multiple exchanges of principal, the conversion factor is multiplied by the number of remaining payments in the derivative contract.

2 For an OTC derivative contract that is structured such that on specified dates any outstanding exposure is settled and the terms are reset so that the fair value of the contract is zero, the remaining maturity equals the time until the next reset date. For an interest rate derivative contract with a remaining maturity of greater than one year that meets these criteria, the minimum conversion factor is 0.005.

3 A Board-regulated institution must use the column labeled “Credit (investment-grade reference asset)” for a credit derivative whose reference asset is an outstanding unsecured long-term debt security without credit enhancement that is investment grade. A Board-regulated institution must use the column labeled “Credit (non-investment-grade reference asset)” for all other credit derivatives.

(B) For purposes of calculating either the PFE under this paragraph (b)(1)(ii) or the gross PFE under paragraph (b)(2)(ii)(A) of this section for exchange rate contracts and other similar contracts in which the notional principal amount is equivalent to the cash flows, notional principal amount is the net receipts to each party falling due on each value date in each currency.

(C) For an OTC derivative contract that does not fall within one of the specified categories in Table 1 to this section, the PFE must be calculated using the appropriate “other” conversion factor.

(D) A Board-regulated institution must use an OTC derivative contract’s effective notional principal amount (that is, the apparent or stated notional principal amount multiplied by any multiplier in the OTC derivative contract) rather than the apparent or stated notional principal amount in calculating PFE.

(E) The PFE of the protection provider of a credit derivative is capped at the net present value of the amount of unpaid premiums.

(2) Multiple OTC derivative contracts subject to a qualifying master netting agreement. Except as modified by paragraph (c) of this section, the exposure amount for multiple OTC derivative contracts subject to a qualifying master netting agreement is equal to the sum of the net current credit exposure and the adjusted sum of the PFE amounts for all OTC derivative contracts subject to the qualifying master netting agreement.

(i) Net current credit exposure. The net current credit exposure is the greater of the net sum of all positive and negative fair values of the individual OTC derivative contracts subject to the qualifying master netting agreement or zero.

(ii) Adjusted sum of the PFE amounts. The adjusted sum of the PFE amounts, Anet, is calculated as Anet = (0.4 × Agross) + (0.6 × NGR × Agross), where:

(A) Agross = the gross PFE (that is, the sum of the PFE amounts as determined under paragraph (b)(1)(ii) of this section for each individual derivative contract subject to the qualifying master netting agreement); and

(B) Net-to-gross Ratio (NGR) = the ratio of the net current credit exposure to the gross current credit exposure. In calculating the NGR, the gross current credit exposure equals the sum of the positive current credit exposures (as determined under paragraph (b)(1)(i) of this section) of all individual derivative contracts subject to the qualifying master netting agreement.

(c) Recognition of credit risk mitigation of collateralized OTC derivative contracts.

(1) A Board-regulated institution using CEM under paragraph (b) of this section may recognize the credit risk mitigation benefits of financial collateral that secures an OTC derivative contract or multiple OTC derivative contracts subject to a qualifying master netting agreement (netting set) by using the simple approach in section 217.37(b).

(2) As an alternative to the simple approach, a Board-regulated institution using CEM under paragraph (b) of this section may recognize the credit risk mitigation benefits of financial collateral that secures such a contract or netting set if the financial collateral is marked-to-fair value on a daily basis and subject to a daily margin maintenance requirement by applying a risk weight to the uncollateralized portion of the exposure, after adjusting the exposure amount calculated under paragraph (b)(1) or (2) of this section using the collateral haircut approach in section 217.37(c). The Board-regulated institution must substitute the exposure amount calculated under paragraph (b)(1) or (2) of this section for SE in the equation in section 217.37(c)(2).

(d) Counterparty credit risk for credit derivatives.

(1) Protection purchasers. A Board-regulated institution that purchases a credit derivative that is recognized under section 217.36 as a credit risk mitigant for an exposure that is not a covered position under subpart F of this part is not required to compute a separate counterparty credit risk capital requirement under this subpart provided that the Board-regulated institution does so consistently for all such credit derivatives. The Board-regulated institution must either include all or exclude all such credit derivatives that are subject to a qualifying master netting agreement from any measure used to determine counterparty credit risk exposure to all relevant counterparties for risk-based capital purposes.

(2) Protection providers.

(i) A Board-regulated institution that is the protection provider under a credit derivative must treat the credit derivative as an exposure to the underlying reference asset. The Board-regulated institution is not required to compute a counterparty credit risk capital requirement for the credit derivative under this subpart, provided that this treatment is applied consistently for all such credit derivatives. The Board-regulated institution must either include all or exclude all such credit derivatives that are subject to a qualifying master netting agreement from any measure used to determine counterparty credit risk exposure.

(ii) The provisions of this paragraph (d)(2) apply to all relevant counterparties for risk-based capital purposes unless the Board-regulated institution is treating the credit derivative as a covered position under subpart F of this part, in which case the Board-regulated institution must compute a supplemental counterparty credit risk capital requirement under this section.

(e) Counterparty credit risk for equity derivatives.

(1) A Board-regulated institution must treat an equity derivative contract as an equity exposure and compute a risk-weighted asset amount for the equity derivative contract under sections 217.51 through 217.53 (unless the Board-regulated institution is treating the contract as a covered position under subpart F of this part).

(2) In addition, the Board-regulated institution must also calculate a risk-based capital requirement for the counterparty credit risk of an equity derivative contract under this section if the Board-regulated institution is treating the contract as a covered position under subpart F of this part.

(3) If the Board-regulated institution risk weights the contract under the Simple Risk-Weight Approach (SRWA) in section 217.52, the Board-regulated institution may choose not to hold risk-based capital against the counterparty credit risk of the equity derivative contract, as long as it does so for all such contracts. Where the equity derivative contracts are subject to a qualified master netting agreement, a Board-regulated institution using the SRWA must either include all or exclude all of the contracts from any measure used to determine counterparty credit risk exposure.

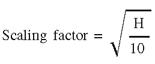

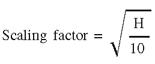

(f) Clearing member Board-regulated institution’s exposure amount. The exposure amount of a clearing member Board-regulated institution using CEM under paragraph (b) of this section for a client-facing derivative transaction or netting set of client-facing derivative transactions equals the exposure amount calculated according to paragraph (b)(1) or (2) of this section multiplied by the scaling factor the square root of ½ (which equals 0.707107). If the Board-regulated institution determines that a longer period is appropriate, the Board-regulated institution must use a larger scaling factor to adjust for a longer holding period as follows:

Figure 1. DISPLAY EQUATION

$$ \text{Scaling factor = } \sqrt{\frac{H}{10}} $$

Where H = the holding period greater than or equal to five days.

Additionally, the Board may require the Board-regulated institution to set a longer holding period if the Board determines that a longer period is appropriate due to the nature, structure, or characteristics of the transaction or is commensurate with the risks associated with the transaction.